BOJ Stands Pat; Yen Weakens to ¥158; Inflation Substantially Below 2% Goal

BOJ Forecasts 2% Inflation in 2024, 2025 and 2026

(See URL below for YouTube of this discussion)

Two weeks ago, the Bank of America and JP Morgan both predicted that the yen was headed toward ¥160/$. At the time, the yen was at ¥154 and was gradually weakening. Yesterday, the yen abruptly tumbled to ¥158.3/$.

There were two triggers. Firstly, the Bank of Japan (BOJ) announced on Friday that it would take no more tightening measures for now. This confounded traders who expected/hoped that it would reduce the pace of its purchases of Japan Government Bonds (JGBs). That would have narrowed the gap between American and Japanese interest rates and therefore would have relieved some of the downward pressure on the yen. The second trigger was that figures for March showed higher-than-previously expected US inflation. Core inflation (ex food and energy) was 2.7%, which is above the Fed’s 2% goal. This news caused US interest rates to rise.

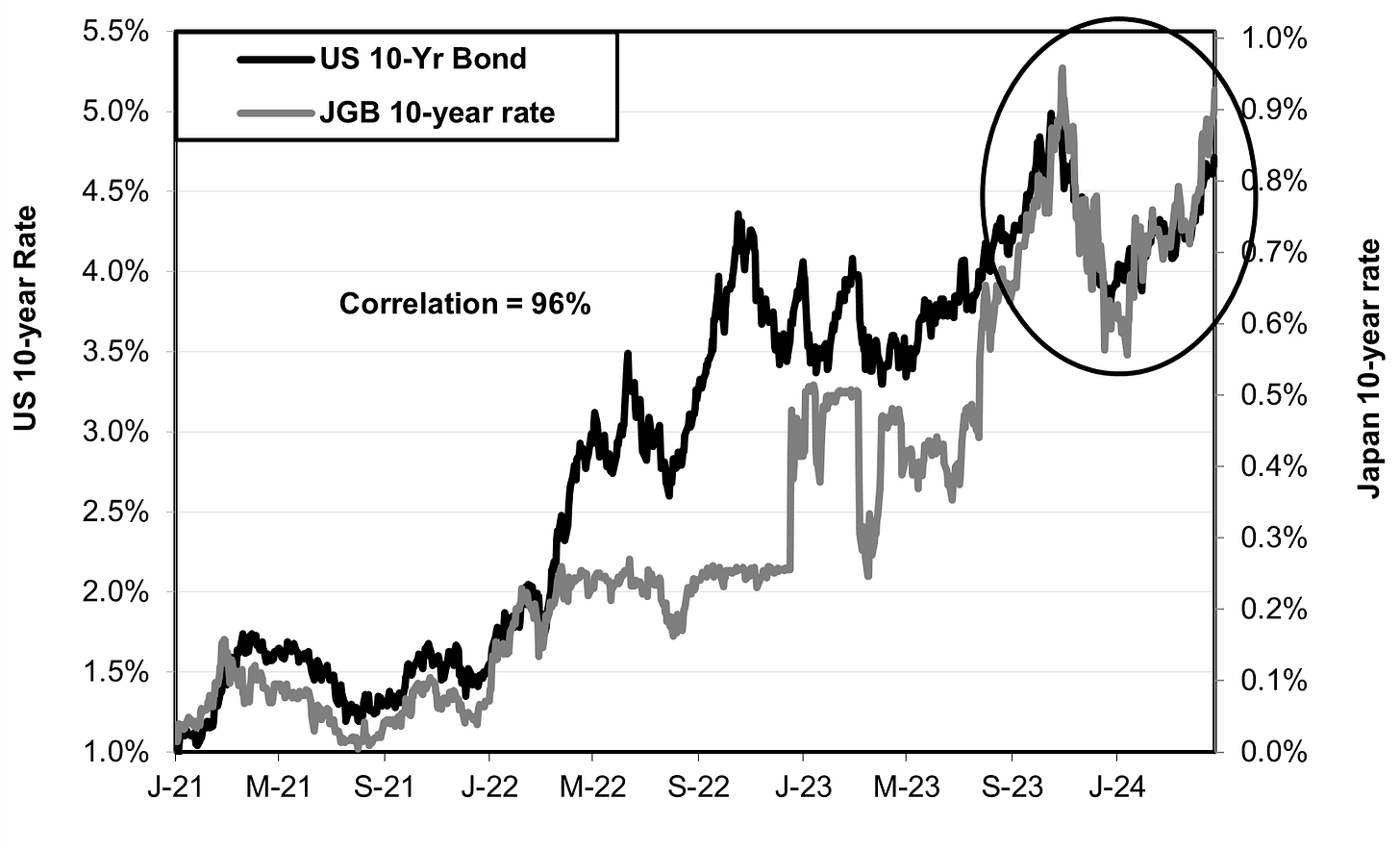

The US-Japan interest rate gap on ten-year government bonds has been rebounding in the last couple of months even as interest rates have risen in both countries (see chart below and the one below that).

Source: Wall Street Journal

As the rate gap rose, the yen weakened further (see chart below). The chart shows the yen on any given day compared to the interest rate gap on the same day. However, traders bet not just on where the rate gap and yen are today, but where they expect it to be down the road. Hence, the weakening of the yen has proceeded more quickly than the rate gap. An equation I made that includes such forward-looking data shows a smaller discrepancy between the rate gap and the yen.

Since a weakening yen raises the price of import-sensitive items like food and energy, and thereby cuts real wages, many analysts and traders believed the BOJ might want to fight this trend by letting JGB interest rates rise at a faster pace. Cuts in real wages hurt the BOJ’s strategy of hoping that rising wages and consumer spending would create healthy demand-led inflation of 2%. Nonetheless, the BOJ decided not to act.

Inflation Substantially BOJ’s Below 2% Goal

As with the dog that failed to bark in the Sherlock Holmes story, it is telling that neither in the just-released BOJ Outlook report, nor in Governor Kazuo Ueda’s Friday press conference, was there any discussion of the fact that inflation in recent months has fallen substantially below the 2% goal.

This fact can be somewhat hidden by year-on-year comparisons. However, if we look at the annual rate of inflation over successive six-month periods, we see that the drop in inflation has been quite stark. In the six months through March, core inflation (ex all food and energy) fell to just 1.4%, while in the BOJ’s preferred measured, inflation ex fresh food and energy, it has fallen to 1.5% (see chart below).

Source: https://www.e-stat.go.jp/en/stat-search/file-download?statInfId=000031431698&fileKind=1

We can see that the trend has continued through April in the figures for Tokyo, which are a leading indicator of the national trend. In the six months through April, inflation for items aside from food and energy was just 0.4%. It was also just 0.4% for all items except fresh food and energy (see chart below).

Source: https://www.e-stat.go.jp/en/stat-search/file-download?statInfId=000032103981&fileKind=1

This drop is finally showing up in the year-on-year basis. The Tokyo figures show just 1.4% inflation for items aside from food and energy when we compared prices in April to those in April of 2023 (see chart below).

In a panel discussion on March 28, former BOJ Policy Board member Sayuri Shirai and I both pointed out this sharp fall in inflation. We contended that future developments on the wage and price front were too uncertain to justify the BOJ’s tweak of policy on March 21. You can listen to it at

Shirai-sensei’s comments begin at minute 18:15 and mine at 36:40. Discussion among the four panelists begins at 1:04:55.

BOJ Believes It Is Hitting “Sweet Spot”

The BOJ has not commented on this sub-2% inflation. Perhaps because it sees this as a temporary blip and is increasingly confident of reaching its stable 2% goal soon. Indeed, in its just-released Outlook report, the BOJ predicted that core inflation (ex-fresh food and energy) would be 1.9% in fiscal 2024 (which began on April 1st, 1.9% in fiscal 2025, and 2.1% in fiscal 2026. Rather than seeing below 2% inflation as a risk, it argued that, “Risks to prices are skewed to the upside [emphasis added] for fiscal 2024 but are generally balanced thereafter.” I’d argue that there are risks on both the upside and downside in 2024.

The BOJ is confident that a “virtuous cycle” between wages and prices is emerging as a result of the big wage hikes at the large companies that take part in the shunto labor negotiations with unions. These talks include only 16% of the labor force. We won’t know for a few months whether, or to what degree, the shunto wage hikes spread to the general labor force. Last year, they failed to do so.

Still, the BOJ does recognize risks to the good wage hike scenario. “It is expected in the baseline scenario that the virtuous cycle between wages and prices will continue to intensify. However, given that many firms, especially small and medium-sized firms, have reported that it has been difficult to pass on their employees' higher wages to their selling prices, the rise in selling prices could be limited... On the other hand, moves to reflect wages in selling prices could strengthen to a greater extent than expected, and upward pressure on wages could intensify with labor market conditions tightening. In this situation, there is also a possibility that both wages and prices will deviate upward from the baseline scenario, accompanied by a rise in medium- to long-term inflation expectations.”

A second risk is higher-than-expected inflation due to a return of cost-push inflation driven by a global rise in commodity prices as well as the weakening of the yen. The BOJ Outlook report said the risks are on both sides: “This risk may lead prices to deviate either upward or downward from the baseline scenario. There are high uncertainties over, for example, the outlook for the global economy, and this could lead to significant fluctuations in international commodity prices. Including future developments in global inflation rates and possible fluctuations in foreign exchange markets, how these factors will affect Japan's prices requires due attention.”

On the whole, the BOJ sees the bigger risk in 2024 to be higher-than-2% inflation. Time will tell.

As to how the weakening yen affects BOJ policy, Ueda repeated the standard policy doctrine at his press conference yesterday: “Monetary policy does not directly target currency rates. But exchange-rate volatility could have a significant impact on the economy and prices. If yen moves have an effect on the economy and prices that is hard to ignore, it could be a reason to adjust policy.”

On most days on amazon.co.jp

We're there any major differences among standard economic KPIs the last time the JPY/USD exchange rate was at this level? If so, what were they? What can we deduce from these differences?