MOF Currency Intervention To Support Yen Would Fail

It Only Works When Fundamentals Are On Your Side

Source: WSJ

This will be short because I am traveling.

Once again, there is talk of Japan’s Ministry of Finance (MOF) intervention to prevent the yen from weakening too much. If so, it will likely fail, just as two interventions in 2022 and two more in 2024 failed. Currency interventions only work when a currency is out of whack with fundamentals. That does not appear to be the case now, just as it was not in 2022 or 2024. For details on those episodes and why it doesn’t work when currency levels are in line with fundamentals, see https://richardkatz.substack.com/p/would-yen-intervention-succeed?utm_source=publication-search’

What is “too much?” Some think the MOF’s “red line” could be ¥155/$ or ¥160. The issue is complicated by Prime Minister Sanae Takaichi’s support for a weak yen; how weak is unclear, as is the relationship between her and the MOF on this issue. However, a week ago, Takaichi’s Finance Minister, Satsuki Katayama, stated in response to a question in the Diet: “We are deeply concerned about the current situation, as we are seeing some very one-sided and rapid movements.” She added that it can’t be denied that the negative aspects of the weak yen are becoming clearer. “The government is watching for any excessive and disorderly moves with a high sense of urgency.”

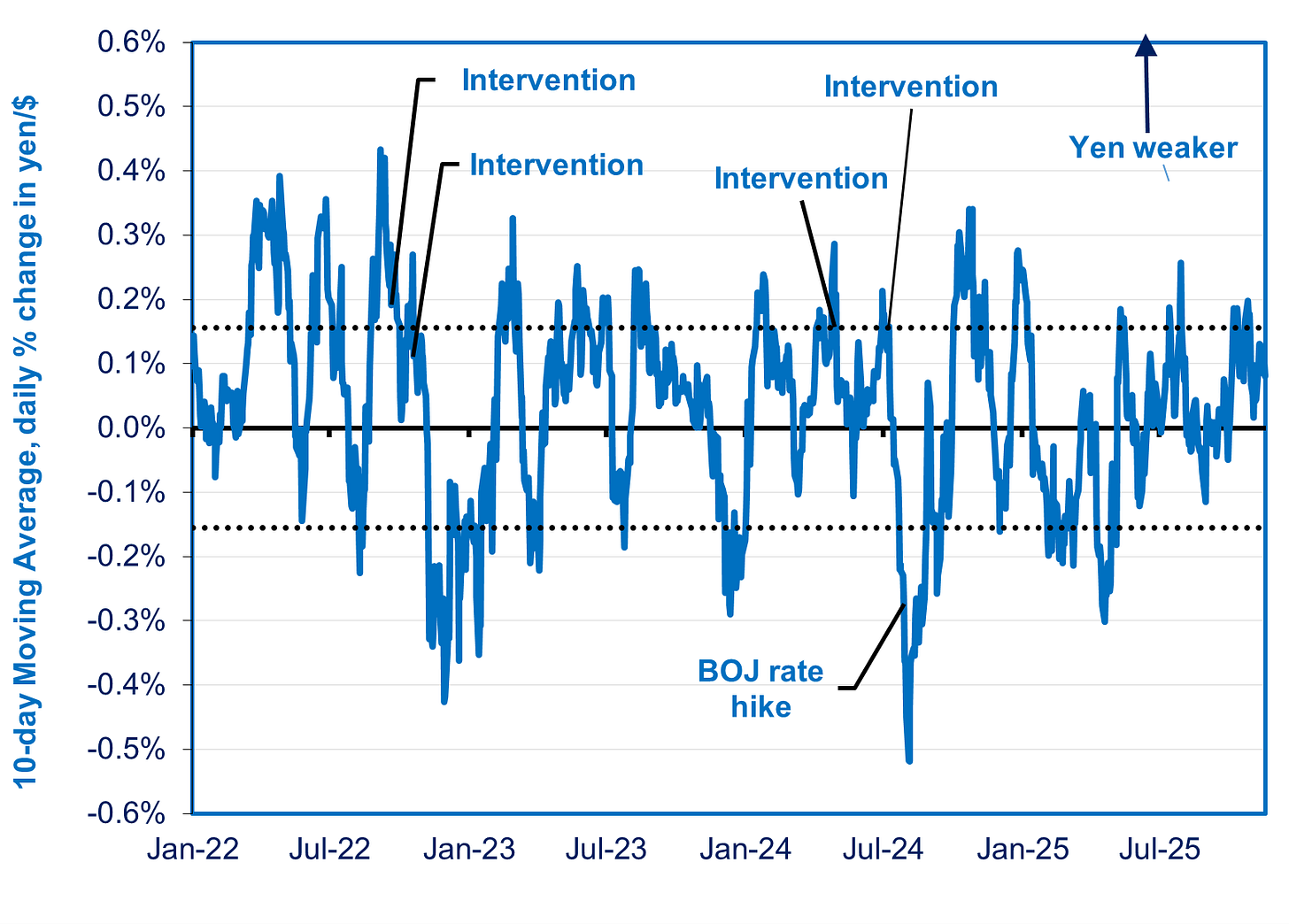

Under international agreements, countries have agreed not to intervene to set a currency’s level, leaving that to the market. Hence, they never admit they are seeking this or that level. They always claim they are acting against wild speculation that makes the market disorderly. There is, however, no such speculation. In the chart below, I show the fluctuations of the yen in a 10-day moving average. The dotted lines are “standard deviations, “which means that two-thirds of the results are within the range of the dotted lines. For example, the top dotted line means the yen has weakened an average of a 0.16% per day. As you can see, recent movements have been within the dotted line. You can also see that all four interventions were done when the yen was weakening, none when the yen was strengthening at an even faster rate.

Source: Author calculation based on WSJ data

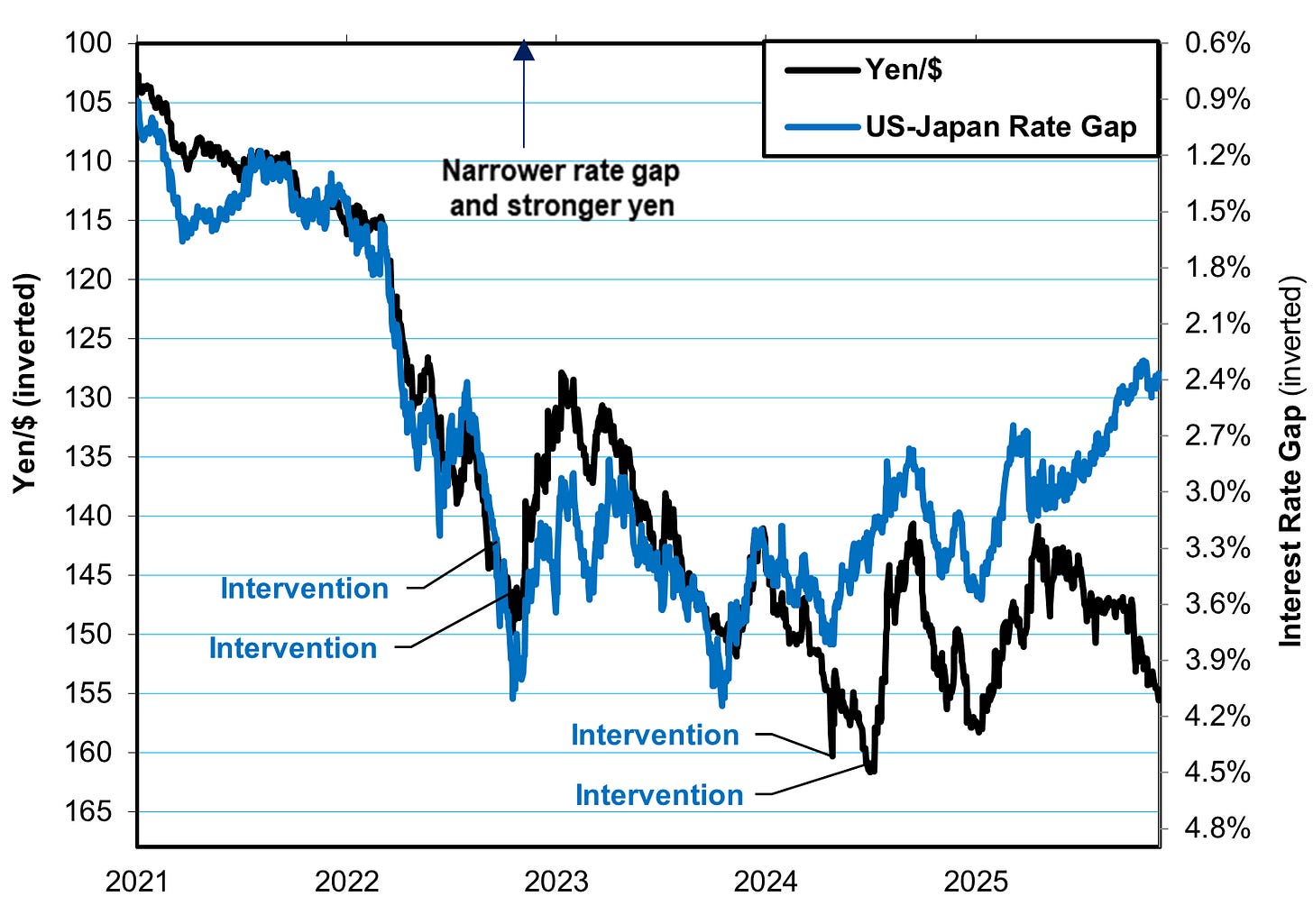

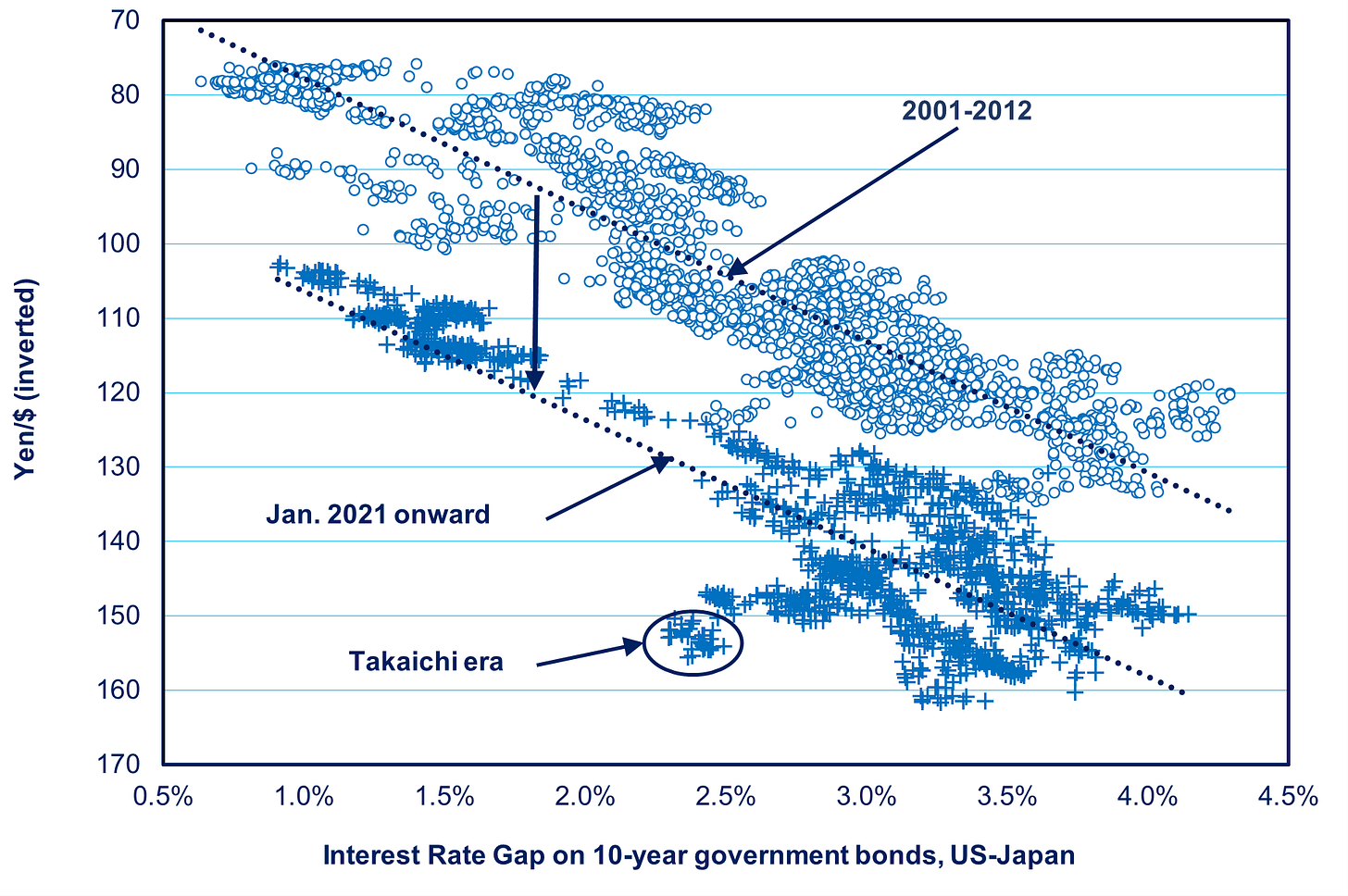

In the short term of a few years, the most impactful fundamental for the yen is the gap between American ten-year Treasury bonds and Japanese ones, as can be seen in the chart at the top. However, over more extended periods, the yen is determined by the balance of payments, which is itself shaped by a country’s fundamental strength or weakness in global trade and financial markets. The yen is much weaker today than a couple of decades ago, primarily because Japan as a country and Japanese exports in particular are less competitive.

Back in 1982, exporters said they could break even with a yen as strong as ¥82. Last year, they said they needed one as weak as ¥127. But among 600 exporters listed in the stock market, a fifth needed a yen as weak as ¥145 to ¥152. The Trump tariffs mean they currently need an even weaker yen.

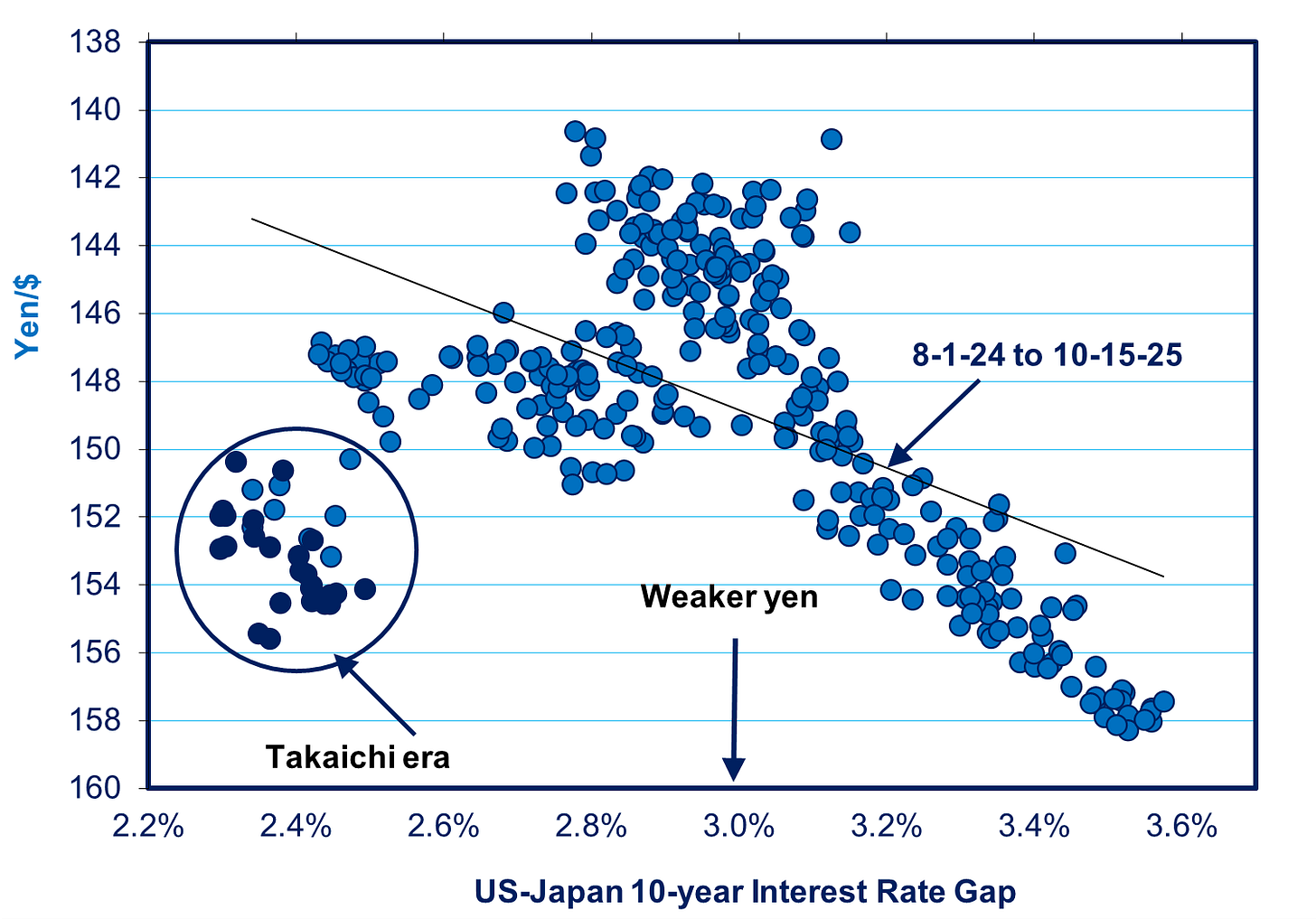

We can see the gradual fundamental weakening of the yen over time in the two trendlines in the chart below. The top trendline shows that when the 10-year interest rate gap was 2.4%, the predicted yen value was ¥102. The bottom trend line shows that since 2021, whenever the 10-year interest rate gap is 2.4% (as it is today), the predicted value was 28 points weaker, at ¥130. However, as the dots show, there is quite a wide spread around the market value trendline on any given day. Since August 2024, the yen’s value on a typical day has been weaker than the predicted value. Since Takaichi’s ascension, it has gotten even weaker.

Does the gap between the predicted rate and the actual rate mean the yen is too weak and out of line with fundamentals? Possibly, butI don’t think so. The market sees Takaichi’s preferred policies—bigger budget deficits and low interest rates—as negative for the yen going forward. And, as I said, there is the Trump tariff impact. On the other hand, the media is interpreting the recent meeting between Takaichi and Bank of Japan Governor Kazuo Ueda as indicating less pressure on the BOJ by Takaichi. The chart below shows how the yen has dropped since Takaichi and the Ishin party made their alliance.

If I am right about the fundamentals, then intervention today, as in 2022 and 2024, will only have an impact for a short time, and in the long run, it will be as if the intervention never occurred.

To Support the Blog

If you feel you’ve gained insight from this blog, ever restacked it, or if you ever subscribed to my previous publication, The Oriental Economist Report, please consider supporting the blog with a subscription or by “buying me a cup of coffee.” You can buy a cup or two on a one-time basis, or once a year, or once a month.

Have you read Richard Werner's Princes of the Yen? If yes, would like to know your thoughts.