The Houthis, A Disappointing Wage Report, and the Tumbling Yen

Market Sees Latest Wage Report Delaying BOJ Rate Hike

Source: Author calculation based on data from Wall Street Journal

(I’m working on a report on the fracas over Nippon Steel’s attempted purchase of US Steel. For the White House to say is a potential security threat is pure election politics, the fear that Biden could lose the White House and Senator Sherrod Brown could lose his Senate and therefore the Democrats likely lose the Senate. CIFIUS does have a technical staff, which is not deemed likely to find any threat. However, their report is not made public and the CIFIUS Committee itself, made up of political appointees, does not need to heed the staff report. The national security route was taken, I was told, because an antitrust case is less political and would not pass muster.)

_____________________________

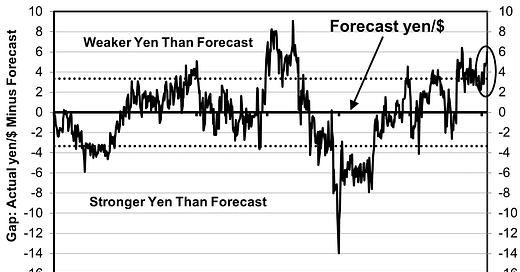

As I write this, the yen has tumbled to ¥148.48/$ from ¥141 at the end of December. This is about 6 points weaker than the ¥142.5 predicted by my simple model (see chart at the top which shows how much stronger or weaker the yen is compared to the forecast; the forecast is represented by the thick black horizontal line at zero).

While the model has been 95% accurate over the past three years, it only takes into account each day’s gap between US and Japanese ten-year government bond rates. It does not take into account emergencies like the Houthi attack on shipping and the resulting avoidance of the Red Sea by many major shipping companies. That is not only likely to raise the price of oil and other products usually shipped through the Red Sea—which impacts the Japanese economy and inflation—but also creates a market hunt for a “safe haven.” In this case, that means dollar assets instead of Japanese and European assets. That has lifted the dollar vis-à-vis those other major currencies,

Nor does it incorporate market anticipation of what might happen to the interest rate gap in the coming weeks. The rate of the yen today is affected by those expectations and not just the current situation. The disappointing report on wages for November, which was released on Jan. 10, means that the market no longer expects the Bank of Japan to raise interest rates at its late-January Board meeting. Moreover, the most recent US inflation report was higher than expected and therefore the US Fed may not cut rates as early as some had expected. That combination, in turn, means the US-Japan interest rate gap will remain higher for longer than was previously expected, or grow even larger as it has over the past weeks. If so, that means a weaker yen than previously expected. I’ll have details on the wage report below.

Is A Yen This Weak Out Of Line?

Over the past three years, the model has been about 95% accurate in how the ups and downs of the yen hinge upon the ups and downs of the gap between American and Japanese interest rates (see chart below)

No model is 100% precise. The so-called “standard error” is about 3.4 yen. In other words, two-thirds of the time, the actual yen/$ rate will be no more than 3.4 points above or below the forecast yen/$ rate (see again the top chart). With the yen at ¥140, that means two-thirds of the forecasts will be off less than 2.4% compared to the actual rate. That’s pretty good.

Today, the forecast is off by about 6 points, or about 4%. As seen in the chart at the outset, that size error is in line with several occasions in the past three years. That could mean that the yen has overshot and become too weak, and it will correct itself, as has happened before. Or, it could mean that the expectations are correct, and the interest rate gap will get larger than it is today. One reason is that the 10-year rate in the US has been rising and could rise even more. Finally, a less likely conclusion is that the economic fundamentals are making the yen even weaker than just a little while ago. But it would take a lot more evidence before we would reach that conclusion: in other words, the gap between the forecast and actual yen would have to stay this high for much longer, and/or the gap would have to rise a lot more.

Disappointing Wage Report For November

As I reported in my January 4th post, back then the market thought there was a 45% chance of the BOJ raising interest rates at its late-January Board meeting, a forecast with which I disagreed. One reason inflation hawks expected an early move by the BOJ was that they expected wage hikes to reach the 3% nominal rate that the BOJ says is necessary for sustained 2% inflation.

Then, on January 10th came the wage report for November. What it showed was that for all workers in establishments of at least five workers, monthly nominal wages rose only 0.2% from the year before, and real (price-adjusted) wages fell once again, this time by 3% from the year before (see chart).

Source: https://www.mhlw.go.jp/english/database/db-l/monthly-labour.html

Since hours worked showed no change, it’s important to look at the growth in nominal wages per hour. They grew only 0.9% in November from the year before, and have consistently been below the 3% goal (see chart below).

When this report came out, it dampened expectations for a BOJ move and therefore any decrease in the US-Japan interest rate gap. That, in turn, sent the yen lower.

Register for my talk about the book at https://bit.ly/3tQn8cc

What do you mean by "CFIUS Council"? please pay attention to the details in the Treasury Dept's helpful factual information on CFIUS, for instance: https://home.treasury.gov/policy-issues/international/the-committee-on-foreign-investment-in-the-united-states-cfius/cfius-overview

On this transaction, see from today https://www.reuters.com/breakingviews/us-steel-deal-stokes-fiery-stakeholder-standoff-2024-01-17/