Tokyo Says: If We Don’t Put Anything in Writing, We Don’t Have to Fulfill Trump’s Demands

Will Trump Issue Executive Order Lowering Tariffs To 15% by Friday?

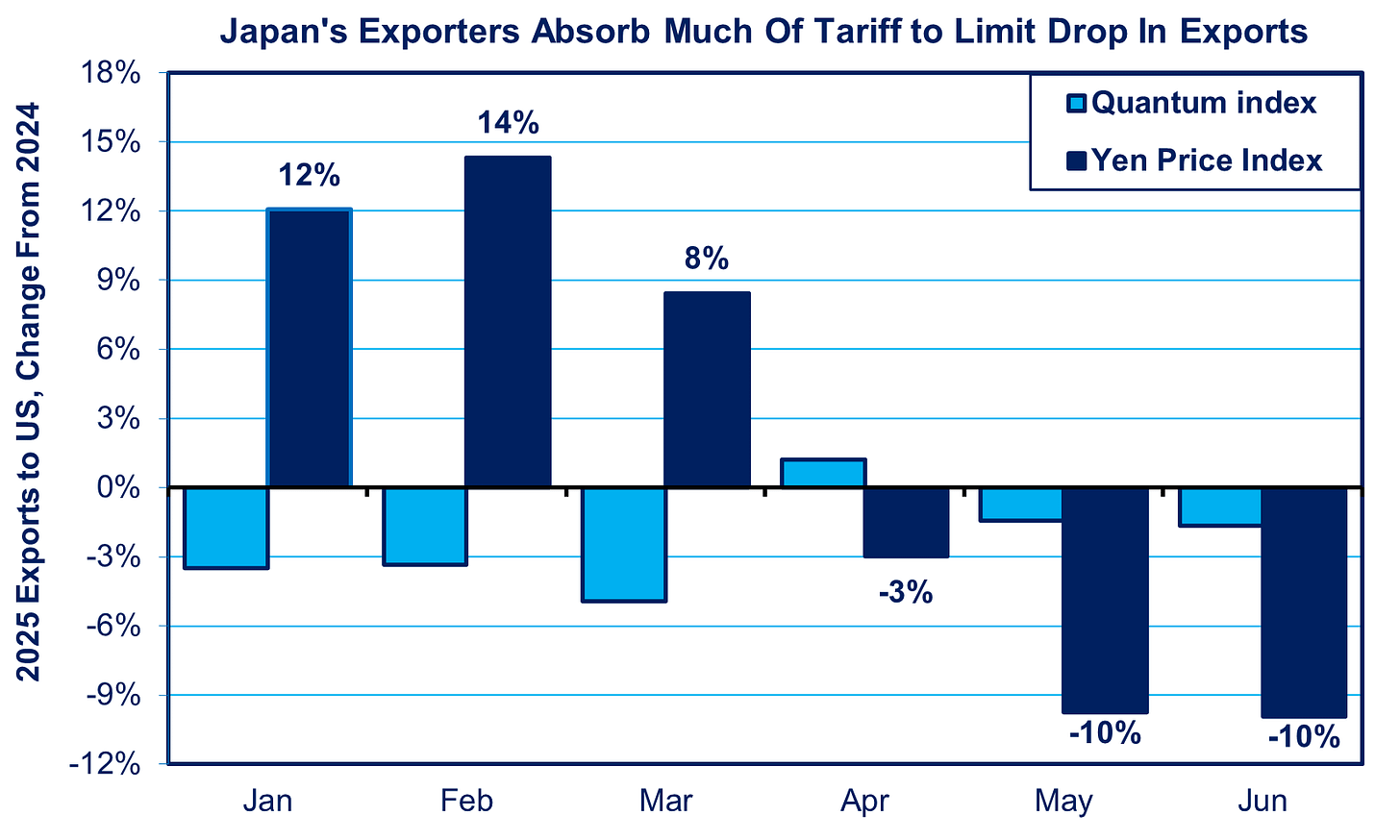

Source: https://tinyurl.com/28nj8274. Note: Japanese companies absorbed much of the tariff hike in April and May by adjusting the yen price, thereby maintaining the dollar price and limiting the drop in sales. The quantum index refers to the number of cars, tons of steel, etc.

Japan, the European Union (EU), and Korea appear to think they can repeat the gambit that China accomplished during Donald Trump’s first term: make him an offer you don’t—or can’t—fulfill. And, in the case of Japan—as explained by Japan’s chief negotiator Ryosei Akazawa—don’t put anything in writing lest Trump look more closely at the fine print.

In his first term, Trump proudly announced that he had extracted concessions from China analogous to those he announced in the past couple of weeks vis-à-vis Japan, the EU, and Korea. This included Chinese imports of $200 billion worth of additional American agricultural and manufacturing products during 2020 and 2021 above and beyond the pace of China’s imports before the trade war. In the end, says the Peterson Institute, “China bought none of the extra $200 billion,” and yet Trump never raised a ruckus about it.

Similarly, last week, Trump boasted that, in return for lowering tariffs on Japanese imports from 25% to 15%, Japan was going to invest an additional $550 billion in the US, select the targets “at President Trump’s direction,” and “the United States will retain 90% of the profits from this investment.” Japan would also buy 100 Boeing jets, greatly expand energy imports from the US, and it would consider investing in a big Alaskan LNG project, one that American private companies like Exxon have abandoned, and buy the resulting products. To top it off, Japan would remove testing requirements on American autos that, in Trump’s mind, are the main obstacle to lots of US auto exports to Japan. In fact, it will make little or no difference, since Detroit does not produce the kind of cars that Japanese householders want to buy. While focusing on these alleged promises, the White House fact sheet made no mention of the tariff reduction from 25% to 15%.

Just a couple of days ago, Trump announced that the EU would invest an additional $600 billion during the remaining years of his term. Moreover, it would buy $750 billion in US energy products. Similarly, as part of a just-announced deal with Korea, the latter would supposedly invest $350 billion in the United States and buy $100 billion of energy products.

Very little of these grandiose visions will turn into reality with any of these three countries. For one thing, as the New York Times, Paul Krugman, William Pesek, and my past posts have pointed out, none of these three countries needs the amount of fossil fuels that Trump is touting. Even if they did, the US is unable to produce that amount for all of them. Oil and gas output is already close to full capacity. Nor can any of these countries dictate to private companies how much and where to invest, or force Japanese households to buy cars that are significantly larger than the ones they prefer.

Secondly, while both Tokyo and Seoul say they never made the promises that Trump alleges that they did, the EU fact sheet repeats Trump’s numbers but says in boldface that the agreement “is not legally binding.”

Japan And Trump Made Different Agreements

Tokyo insists that it made a very different deal than the one Trump crowed about. And, since there is no joint statement—and no intention to compose a legally binding agreement—no one really knows what words each side used. For example, Japan says it never promised $550 billion in new investments. All it offered was to make government loans and credit guarantees up to that level to help companies that desire to invest more in the US. However, it has no power to force private companies to make investments that they don’t need. Nor has it given Trump the power to direct the investments. As for profit-share, Japanese government funds will finance only 1-2% of the future deals via equity investments (the rest being loans) and profits will only come from that 1-2%; the American profits share will not be 90%, but will be “based on the degree of contribution and risk taken by each party.” One hunrded Boeing jets is just the number of jets that Japanese airlines said they are already planning to buy over several years; there is no increase in the number.

Who knows what happened. Did Trump say 90% of the profits and Akazawa simply fail to contradict him, or did Trump make it up after the event?

In fact, Akazawa more or less admitted at a press conference that Japan does not want a written agreement because the absence of one enables Japan to avoid meeting the terms that Trump claimed. As long as Japan can get Trump to lower America’s import tariffs to 15%—and it wants this done by tomorrow (August 1st)—“strategic ambiguity” is Japan’s friend. It can evade the promises Trump may think Japan made—or that Trump is just making up now—all the while insisting that Japan is fulfilling its part of the bargain. In a TV interview, Akazawa argued that, if a written bilateral agreement were to be drawn up, Trump and his team would want to pin down details, and that would increase the chances of him changing the deal to make it more onerous. In commenting on this interview, Nikkei wrote, “What Japan gets from the deal is definite, and what Japan is offering is being left vague, said a Japanese government source.... Crafting a written agreement may not be in Japan's best interest. Creating a written agreement could force Tokyo to agree to the US's terms.”

Tokyo is taking a big gamble. It is assuming that Trump will treat Japan the way he treated China earlier. But China has far more leverage over the US. For example, it can retaliate by cutting off the supply of rare earth metals. Trump’s backdown a couple of months ago shows even he recognizes US vulnerability on this front. Japan, by contrast, feels too dependent on the US on both the economic and security fronts to retaliate.

What happens if Trump is shown Akazawa’s press conference and decides he’s been tricked? As Treasury Secretary Scott Bessent said, “If Japan doesn't stick to the terms of the deal, tariffs will go back up.” And it is Trump who will decide whether or not Japan is living up to the terms. Tokyo did not even secure a promise by Trump to issue the Executive Order lowering the tariffs to 15% by any particular date. Until he does, the 25% tariff rate remains in effect. Some Japanese exporters lose millions of dollars every day that the higher tariff remains.

Private analysts point out the risk. Professor Masahiko Hosokawa, a former official at the Ministry of Economy, Trade and Industry (METI), worried, “If Japan leaves the U.S. side’s self-serving interpretations, such as those concerning investment in the United States, unchallenged, it will be taken as tacit acceptance, which could lead to future friction and risks.” Takahide Kiuchi, an executive economist at Nomura Research Institute, argued, “Even if clarifying the detailed framework reveals discrepancies between the two countries that could lead to the collapse of the agreement, a formal document should still be created.”

There is, however, a plausible counterargument, one that the Ishiba administration finds persuasive. Even when there are legally-binding pacts, Trump cavalierly violates them. Trump just forced South Korea to agree to 15% tariffs, in violation of the official Free Trade Agreement (KORUS) that Trump himself renegotiated in his first term and modification of which requires Congressional approval. He has done the same vis-à-vis Canada and Mexico. “Even if there is a written agreement [between the US and Japan], the US right now is a country that would not hesitate to break it,” said Kazuhisa Shibuya, a professor who was involved in the 2019 US-Japan trade negotiations as part of the Cabinet Secretariat.

Conclusion: The Fragility Of Coerced “Agreements”

There’s a lesson here. When countries feel they’ve been coerced into making agreements at the point of a gun—especially by someone who can be trusted not to keep his word even when he signs legal contracts—they, in turn, feel no compunction to evade living up to America’s vision of what was agreed upon. Destroying trust makes both sides worse off.

P.S. Judges Skeptical of the Legality of Trump’s Reciprocal Tariffs

Judges at today’s hearing before the U.S. Court of Appeals seemed skeptical that Trump could impose his “reciprocal tariffs” without Congressional approval, and that he could use the International Emergency Economic Powers Act (IEEPA) to do so. On May 28, the Court of International Trade ruled that these tariffs are illegal, but the Appeals Court said they could be implemented while it reviewed the issue. Even if the Appeals court rules against Trump, it may allow the tariffs to continue while an appeal to the Supreme Court proceeds, something that could take months and months. The case does not cover the tariffs on autos and steel, where Trump used Section 232 (national security) to justify the tariffs.

Note On US GDP in April-June: Less Than Meets the Eye

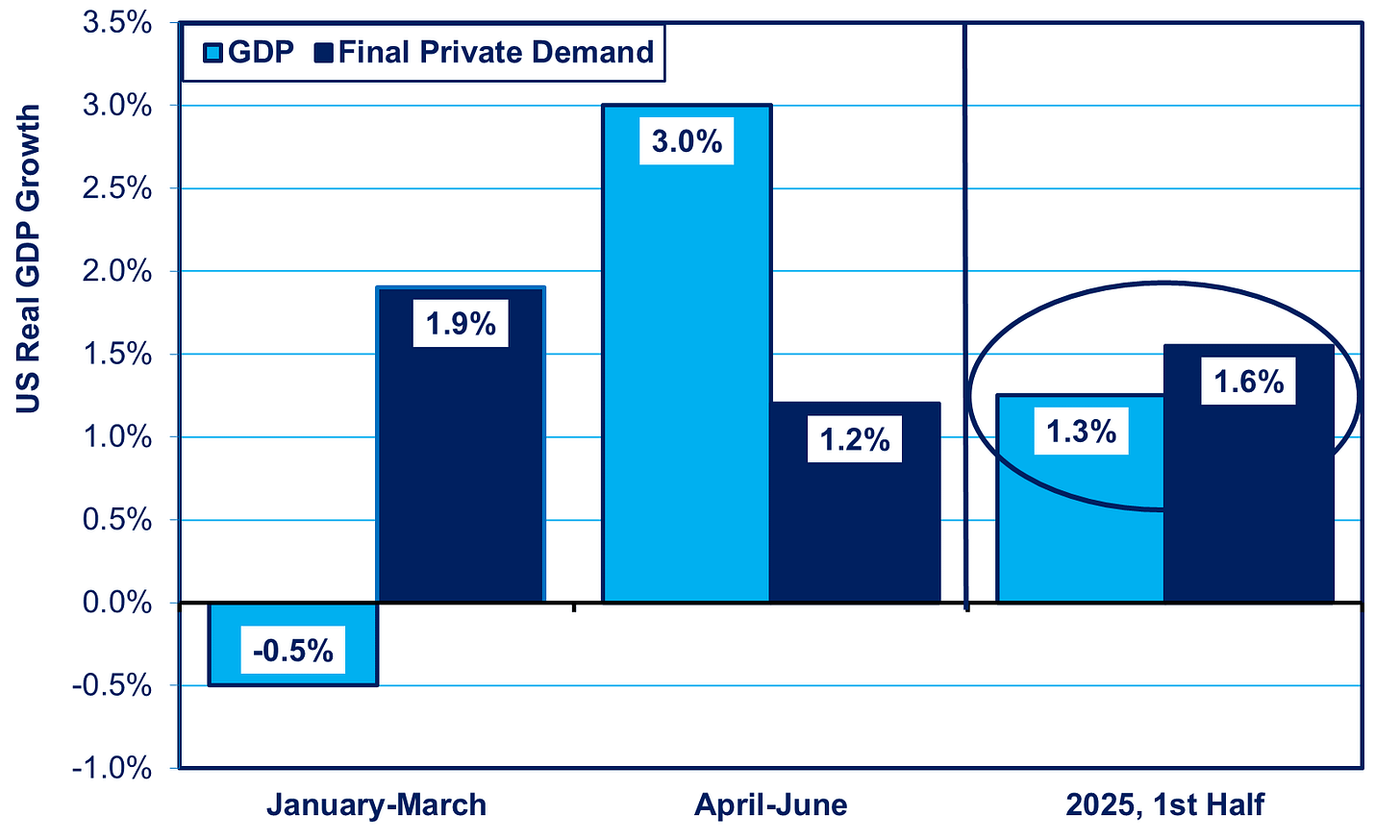

Trump supporters point to the latest GDP numbers showing that GDP grew at a 3.0% annual pace during April-June. They assert that this means that his tariff war is not hurting growth. However, this is a statistical illusion caused by people rushing to import goods in January-March to acquire them before tariff rates increased, and then importing less during April-June. That artificially suppressed the January-March number, turning it negative, and the effect was reversed in the April-June period.

If we look at GDP for the entire January-June period, the growth rate was just an anemic 1.25%. Moreover, even in the supposedly robust second quarter, private final demand —i.e., purchases by consumers and companies, excluding government spending and trade —increased by just 1.2%, down from 1.9% in January-March, marking the slowest rate since 2022 (see chart below).

To receive new posts and support my work, consider becoming a free or paid subscriber.