Video: Trump's Impact On Japan’s Economy

Entering a Period of Uncertainty

How will Donald Trump impact the Japanese economy—assuming he carries out anything close to what he vowed in his campaign? Four of us were brought together by Anthony Rowley of the Foreign Correspondents Club of Japan to give our opinions. It was a fascinating and lively discussion, one held during a time of great uncertainty. Here are just a few of the many highlights. None of us were fans of Trump, but we differed on the severity of his impact.

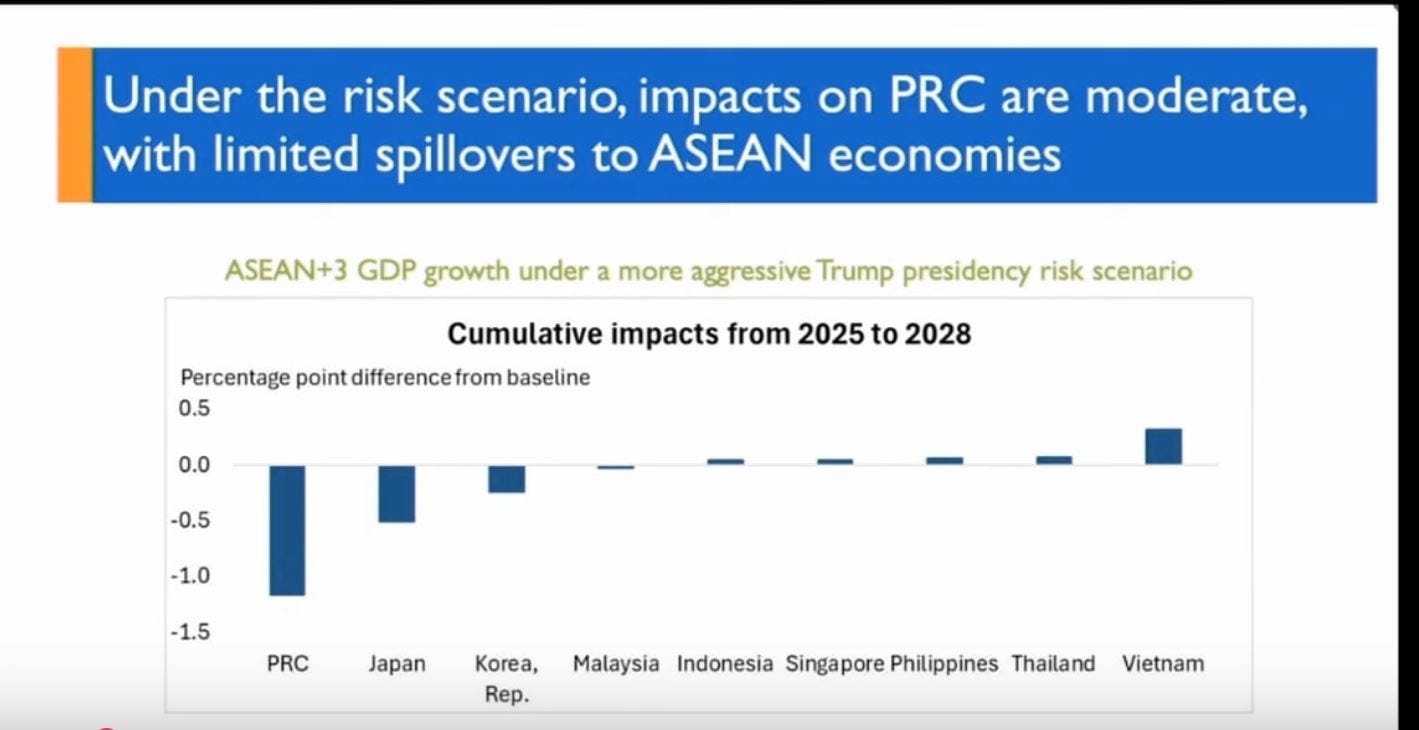

Leading off was Albert Park, chief economist of the Asian Development Bank, who projected a surprisingly mild outcome—except for Japan—even in his “risk scenario.” The latter means, among other things, that Trump goes ahead with 60% tariffs on China and 10% tariffs on all other countries, and those countries retaliate. In China, total GDP growth over the coming four years would be 15.4% instead of the IMF’s baseline forecast of 16.4%, i.e., 6% less growth than in the baseline (see chart below). Korea’s GDP would grow 8.6% instead of 8.8%, a falloff of 3%. In Japan, however, the impact would be somewhat more substantial even in Park’s relatively benign scearnio. GDP would grow just 2.8%, 15% less than the baseline forecast of 3.3%.

In much of the rest of Asia, the ADP predicts that the impact would be negligible. Vietnam would be helped as some multinational companies shifted production from China to Vietnam (see chart below).

Park is hardly alone in this view. However, I believe that econometric projections based on times of moderate change don’t necessarily work well in times of radical change. For example, the normal projection is that, for each 10 percentage point hike in US tariffs, US imports fall by 10%. That may work when tariffs go from 3% to 8%, but do they still work well when tariffs go from 10% to 60%? Or in a world of delicate supply chains? Think of how global auto production was hampered by the shutdown of some Japanese plants following the 2011 tsunami, a real-life case of the poem “For want of a nail, the war was lost.”

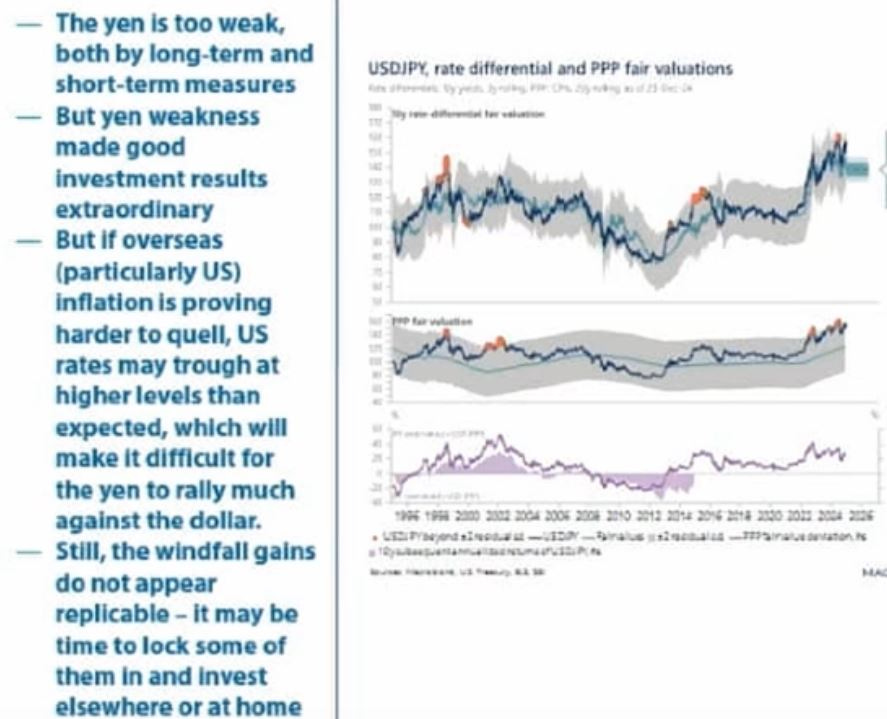

Next came Naomi Fink, Chief Global Strategist for Nikko Asset Management. She also presented a relatively benign picture for Japan, arguing that various positive developments in Japan could insulate the country from the external shocks unleashed by Trump. She said it was time to invest in Japanese stocks and looked toward a recovery of the yen, contending that the latter was undervalued (see below).

In fact, Fink focused on the significant risk factors for the US from Trump’s counter-productive policies. America runs a chronic deficit in goods and services trade and in the broader current account. A staple of economics is that such international deficits must be financed by investment inflows from the countries running current account surpluses, e.g., China, Japan, and the oil producers. Fink asked: will these be willing to keep financing the US deficits under these circumstances, or will they demand much higher US interest rates to do so? “America First costs money,” she pointed out.

I came next. First, I argued against the view often expressed in Japan that because Trump is a businessman, he will do what’s best for the US economy. I believe he will do what increases his own power. Given the mood of his voter base—severe populism, nationalism, isolationism, and protectionism—the measures that increase his power are not ones that benefit either the US or Japanese economies or global security. For example, while his steel tariffs (continued by Joe Biden) led to a 26,000 job increase in the steel sector, they caused a loss of 433,000 jobs in the steel-consuming industries like autos and machinery.

Secondly, Japan is quite vulnerable to external shocks, such as those that Trump is planning. Consider the history. The Asian crisis of 1997-98, including Japan’s homegrown banking crisis, the global “great recession” of 2008-2009, and the Covid-Ukraine crises, had a much greater impact on Japan than one would have predicted: 5-6 years of zero growth in each case (see chart below). Today, one of those shocks would be high tariffs against China because Japan’s exports to China hinge on China’s own exports to the US. Together, China and the US buy almost 40% of all Japanese exports.

Source: Cabinet Office, IMF, ADB

The final speaker was Jesper Koll, Expert Director of the Monex Group. He pointed to the dangers in a world where perceptions (or misperceptions) of national interest and national security are prevailing over economic rationality. This came through when discussing the broader implications of the ruckus over Nippon Steel. In contradistinction to Fink, Koll said a yen weakening to ¥200 or ¥220 was a “perfectly reasonable forecast” even if Trump does just half of the “Maganomics” that he’s talking about.

Other issues that came up included the security consequences of “America first," Japan’s relations with China, and Japan’s high food prices.

To watch the hour-long conversation, click here)

To provide more support, donate several subs at $50 each. You do not need to name the sub recipients, just how many. This is a one-time contribution; it does not repeat automatically. Please click the button below.