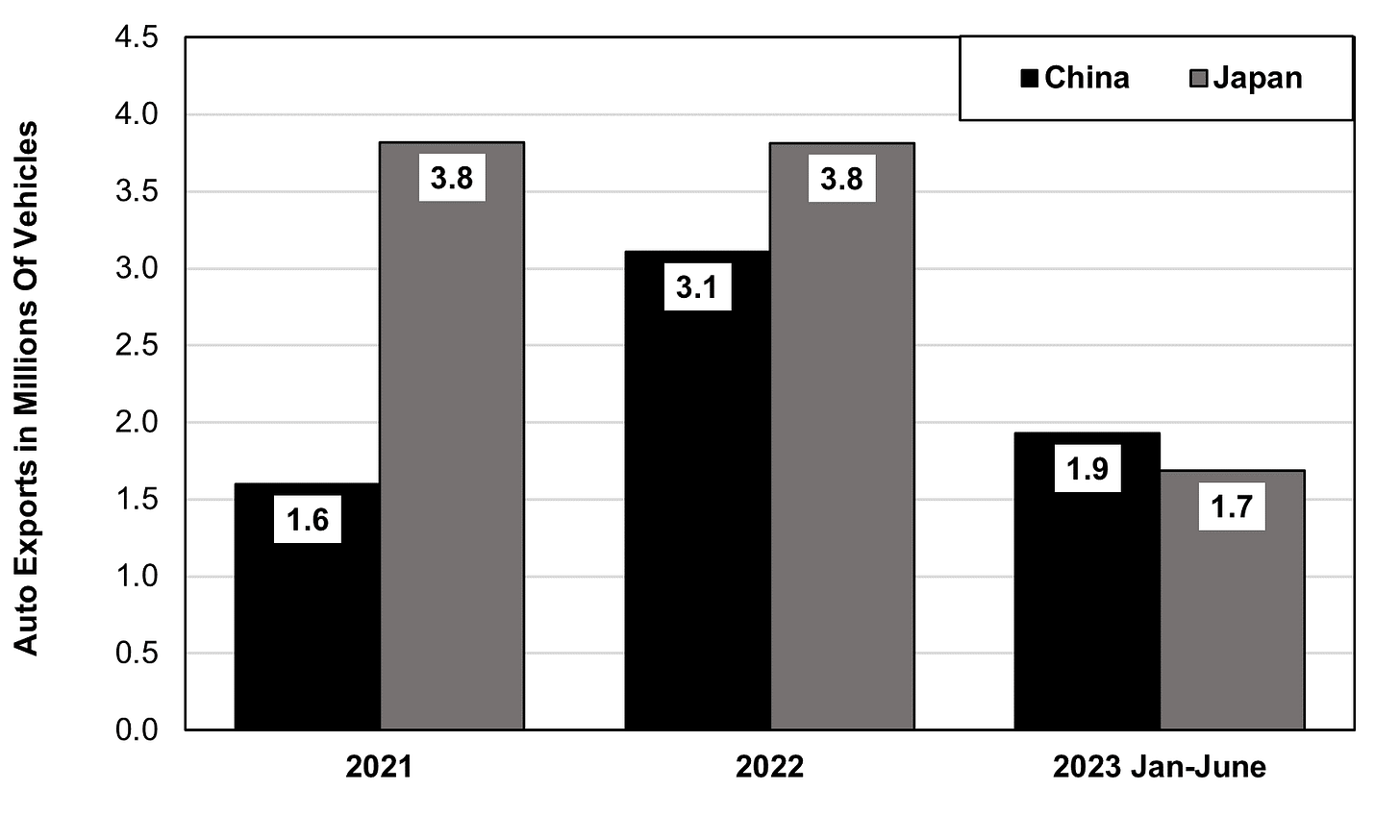

China Replaces Japan As Top Auto Exporter in Jan-June 2023

Falling Japanese Share of Global Auto Production

Source: Press reports for China; for Japan, https://jamaserv.jama.or.jp/newdb/eng/index.html

Who knew it would happen so soon? In a post back in April, I reported that China was on track to overtake Japan in auto exports, but I thought it would take at least a couple of years. But no: China has already surpassed Japan in the first half of this year (see chart above). Moreover, in just the first five months, China exported more cars than in all of 2021. If current trends continue, China could export as many as 4.4. million vehicles for 2023 as a whole, up from 3.1 million in 2022, when it was behind Japan at 3.8 million. Chinese automakers are confident that this will come to pass: “If this trend continues, it is very likely that China will surpass Japan to become the world's largest auto exporter in 2023,” said Cui Dongshu, secretary general of the China Passenger Car Association. But it is also possible that Japan’s relative weakness is partially an artifact of Covid and it will take a bit longer for China’s triumph to be sustained.

Given that vehicles account for 18% of all Japanese exports, Japan’s relative decline in autos shows that a cheaper yen alone cannot solve Japan’s export problems. Moreover, when combined with declining car sales at home, the relative decline in exports hurts the auto industry’s ability to have enough domestic production to support its base of suppliers, technicians, and skilled personnel.

Exports vs. Overseas Production

When I first wrote about this, one reader commented that exports are not the best measure of Japanese competitiveness in autos because Japan’s automakers sell far more vehicles overseas through overseas production. After all, 85% of Japanese brand vehicles sold overseas are built in Japanese plants overseas (see chart below).

Source: JAMA at https://jamaserv.jama.or.jp/newdb/eng/index.html and https://www.jama.org/the-motor-industry-of-japan-2022/; and press reports

Moreover, exports and overseas production combined dwarf domestic sales (see chart below).

Nonetheless, automotive exports are important for the performance of Japan’s overall exports and for the economy as a whole. Autos and auto parts currently account for nearly 20% of all manufacturing shipments and capital investment, while automotive production, sales, repairs, etc., directly and indirectly, account for 8% of all jobs. Thus, it is telling that auto exports in the pre-Covid year of 2019 were down almost 40% from the 2008 peak and by 2022 were down by more than half from the peak.

Plus, the weakness extends beyond exports. Japan seems to be suffering a similar decline in sales from its overseas plants. In 2022, overseas output was down 20% from its 2018 peak (see again chart above). Covid is just a part of the story. Japan’s share of total global auto production by all countries peaked at an incredibly impressive 33% back in 2008, and is now down to 28.4% and could sink even further due to both the rise of China and Japan’s lag in battery-powered electric vehicles (BEVs) (see chart below).

Source: https://www.oica.net/production-statistics/ and press reports for 2023. Note: 2023 figures cover Jan-May.

Some of this decline in market share is the natural effect of the explosion in auto production in China and Japan’s smaller share in the Chinese market than American and German brands. Auto production in China, by domestic and foreign companies combined, now accounts for about a third of global vehicle output, up from 13% in 2008.

Beyond that unavoidable trend is the fact that Japanese automakers have shot themselves in the foot by their resistance to BEVs. Not one Japanese automaker is among the top 20 producers of EVs.

Behind China’s Export Surge

In 2023, China is predicted to double to 1.3 million its exports of New Energy Vehicles (NEVs), i.e., traditional hybrids, plug-in hybrids, and BEVs. As a result, NEVs would comprise 30% of the projected 4.4 million in exports of all vehicles.

A second reason is that China has stepped into the vacuum created by the departure of other automakers from the Russian market. In January-May, China exported 287,000 vehicles to Russia, almost twice as much as runner-up Mexico at 159,000, and 16% of China’s total auto exports.

Thirdly, China is moving toward more upscale markets, like Europe, as well as other countries, like those in Southeast Asia. In 2022, according to the Canalys automotive analyst firm, Chinese automotive products had a market share of only 2.6% in S.E. Asia, but that will rise to 12.8% by 2025. That, in combination with an effort by Korea’s Hyundai and Kia, will hurt Japanese automakers who have held a 90% market share in SE Asia for decades. In Thailand, traditionally a Japanese stronghold, BEV sales rose from a trivial amount in 2022 to a 7% market share in early 2023.

Meanwhile, in Europe, China’s share of passenger car sales is expected to rise to 16.5% by 2025.

Chinese brands are not expected to do well in the US because the high tariffs imposed by the Trump administration that have been maintained under Biden.

As Chinese companies move upscale, they are able to charge higher prices. According to Canalys, the average selling price of Chinese car exports increased 25% from RMB 112,000 ($15,670) in 2021 to RMB 140,000 in 2022. In the European market, the figure was RMB 210,000 in 2022.

Losing the China Market

Moreover, while China’s auto industry used to be dominated by joint ventures between Chinese firms (mostly state-owned) and foreign automakers, fully domestic firms are now taking a larger share of both exports and domestic sales. Domestic automakers had a 52% share of domestic sales in the final quarter of 2022, up from 47% the year before.

One big reason is that the domestic companies have an 80% share in EVs, which are rising in popularity and now comprise about a quarter of the overall Chinese vehicle market. In passenger cars alone, New Energy Vehicles accounted for 34% of all sales. BEVs alone accounted for 24% of all car sales. In terms of all vehicles, not just cars, BEVs in 2022 accounted for 20% of all sales, up from just 5% in 2020 (see chart below).

Source:

https://www.statista.com/statistics/425466/china-annual-new-energy-vehicle-sales-by-type/; https://carsalesbase.com/china-car-sales-data-market/; https://apnews.com/article/beijing-business-83fae6485077278a093321c9830e5219

All of this particularly hurts Japanese automakers since China is now such a huge portion of their market. In 2020, Japanese production in China comprised almost 30% of their entire overseas output, and one out of every five vehicles sold either at home or overseas. In the first quarter of 2023, the Japanese share of auto sales in China was just 18%, down from 24% in 2020 (see chart below).

Source: https://www.carscoops.com/2023/05/japanese-automakers-struggle-in-china-as-local-ev-manufacturers-dominate-market/ Note: 2023 share in first quarter

Mitsubishi’s joint venture has already suspended production in China indefinitely. Honda’s joint venture has suspended producing and selling Acura models. Toyota just laid off 1,000 of its contract employees in China, about 5% of its 19,000 employees at the joint venture.

Auto Parts Vulnerable to Loss of Share by Big Automakers

Japan’s auto parts industry is about the same size as the auto assemblers: each of them an average of around ¥19 trillion over the past decade. The peak year for domestic production was 2007. As with the assemblers, the parts makers now produce more overseas than at home, the majority of that to supply the overseas operations of the assemblers (see chart below). In addition, the parts makers export about a fifth of the value of their domestic output. Hence, anything that hurts overseas sales of the assemblers hurts the parts makers as well.

China’s Fuel Cell Ambitions Fall Flat

One other interesting note for Japanese automakers and policymakers still pursuing the dream of a hydrogen fuel cell vehicle (FCV).

Despite massive subsidies, China’s efforts to push FCVs have floundered just as badly as those of Japan. Consumers simply don’t want to buy them, so the government is focusing on trucks. Nonetheless, in 2022, companies bought almost 300,000 commercial electrified trucks, almost 10% of all commercial vehicles sold in China. By contrast, they bought only 3,700 FCV trucks.

Experts agree that hydrogen can have big advantages over EVs when it comes to large vehicles like heavy trucks, buses, ships, and the like, but not cars. That’s because batteries for such vehicles are far too weighty, given today’s technology. Unfortunately, making hydrogen practical has a long way to go, especially since most hydrogen being used today is very carbon-intensive, and green hydrogen (made by electrolysis of water) is still extremely expensive and requires renewable-based electricity to be truly green.

Congrats on another excellent analysis! The only thing I would add is that leading Chinese EV maker BYD has already entered the Japanese market and is aggressively marking its cars. I see their Japanese language adds in my FB feed all the time, and a university colleague just bought a BYD and so far is satisfied.

This is the beginning of the end for Japan. Things can go direful for Japan if the conflict in Taiwan occurs.