Hope For A Deal between Nippon Steel and the Steelworkers Union Before Election Day

Would End National Security Blockage

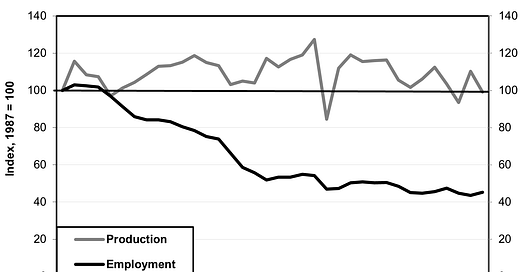

Source: https://fred.stlouisfed.org/series/IPN3311A2RA

Note: Even though US steel production has been flat since 1987, employment is down 55%, mostly due to automation. Workers, however, often blame imports.

Long-awaited good news arrived today for those seeking to avoid a rupture between the US and Japan over Nippon Steel’s attempted purchase of US Steel (USS). The United Steelworkers Union (USW)—which, up until now, had acted in public as if it opposed the buyout under any conditions—signed a Non-Disclosure Agreement (NDA) with Nippon Steel. That means that they will now engage in serious and secret negotiations in the hopes of reaching an agreement enabling the USW to endorse the buyout. Moreover, according to clued-in observers, both sides would like to reach such an agreement before the November elections. That would pave the way for the Biden Administration to do what it has always wanted to be able to do: say that the deal poses no threats to national security under the rules of the Committee on Foreign Investment in the United States (CFIUS), which investigates thousands of deals for any such problem.

From a political standpoint, this was never an ordinary purchase of an American company by a foreign one. When the purchase agreement was first announced in December, the USW denounced the notion of a foreign company buying USS, and criticized NS in particular, as did all four Senators in the key electoral states of Pennsylvania (the headquarters of USS) and Ohio. Former President Donald Trump raised the electoral stakes by vowing to block what he called a “horrible” merger “instantaneously.”

In the face of this political uproar, Lael Brainard, director of the National Economic Council, announced back in January that President Joe Biden “believes the purchase of this iconic American-owned company by a foreign entity — even one from a close ally — appears to deserve serious scrutiny in terms of its potential impact on national security and supply chain reliability.” In reality, however, the Biden administration never had any desire to block the merger, and certainly not on the insulting grounds of national security. It understands how much disapproval would damage US-Japan relations. Yet, an already unpopular Biden as well as Congressional Democrats also faced lots of political pressure due to rising nationalism and protectionism among both Democratic and Republican voters. The only sure way out of this dilemma was for NS to gain acceptance from the USW.

What most people don’t know is that NS and the USW “have been engaged in a dialogue...since the transaction was announced in December,” an NS spokesperson told me in an email response to written questions a couple weeks ago. “We are committed to finding common ground with the USW.” Up until today, the dialogue consisted mostly of talk between lawyers to create the ground rules for the talks, including the NDA. Now, it is hoped, serious substantive talks can begin in the next few weeks. This dialogue leading to the NDA has not been reported in most of the press, in part because the union has talked as if it would never accept a foreign takeover. Indeed, last week, the USW’s press spokesperson did not even respond to an email asking it to confirm the dialogue. However, if there were no conditions whereby the USW would accept the buyout, why would it engage in talks at all? It seems as if its harsh rhetoric is a negotiating tactic of “playing hard to get.”

None of this means reaching a deal will be easy, not that it can necessarily be accomplished before the election, but both sides are serious about the effort and the timing.

Election Year Politics

The entire fracas results from election-year politics. President Joe Biden probably cannot win reelection unless he wins Pennsylvania. In addition, the Democrats would find it very hard to retain the Senate unless Sherrod Brown wins re-election in Ohio. On the other hand, if the union declared itself satisfied with a pact with NS, the White House and the Democratic Senators in these states would be free to endorse it.

The Biden Administration is well aware that the real threat to US-Japan relations—and therefore the national security of both countries as well as others in the region—would come from calling Nippon Steel (and implicitly Japan) a security threat. It would be a gift to an increasingly bellicose China. An even greater threat to US-Japan relations and regional security would come from a return to power by Donald Trump.

Biden has never said he opposes the deal, only that it deserves scrutiny by CFIUS. The fact is that CFIUS has reviewed countless Japanese acquisitions and none have been blocked. Softbank was compelled to make a small modification and it’s possible that NS could be compelled to give up some assets in China, a tiny fraction of its revenue. But CFIUS is not a strictly legal process; it’s a political one. Even if CFIUS’s technical staffers found no national security threat, the Cabinet-level body and the President could still forbid the deal and the public would likely never even find out what the staff report said.

The good news on the political front is that there is no bandwagon in Congress against the deal. Only four Democratic and three Republican Senators, plus 53 members of the House of Representatives’ 435 members from both parties, have denounced the merger. Moreover, neither of the two Democratic Senators running for re-election in critical states, Brown of Ohio and Bob Casey of Pennsylvania, have mentioned the NS issue very much in their campaign speeches since their initial comments in December, shortly after the deal was announced. It’s not a big concern for most voters but in a close election, any issue can tip the balance.

Consequently, the surest way to secure the merger is for NS and the USW to come to an agreement before November’s election. In public, NS has sometimes talked complacently. Indeed, when I asked whether a deal with the USW was politically necessary, a spokesperson emailed me an answer that seemed to treat the whole matter as if it were strictly a legal issue, saying, “We believe the CFIUS process will determine that our transaction does not pose any threat to national security.” Nonetheless, in private, NS leaders were said to be well aware of the need to make a deal. The creation of the NDA confirms this.

Can A Deal Be Made?

On the surface, the union has talked up until now as if it objects to NS simply because it is a foreign firm and because it preferred a takeover by the first bidder, a company called Cleveland-Cliffs (CC) that is very friendly to the union.

However, a takeover by CC would likely never have been approved by antitrust regulators. The new company would control 100% of American iron ore reserves and the majority of steel used by American automakers while becoming the sole producer of the kind of steel used for electric vehicle engines, and the sole owner of all American “integrated” steel mills in the US, i.e., mills that can do everything from processing iron ore to making finished products. That concentration would likely raise steel prices and thereby reduce the competitiveness of steel users, like automakers. The Alliance for Automotive Innovation—a coalition including both the Detroit Three and foreign companies like Toyota, Volkswagen, and others—immediately fired off a letter of protest to Congress, as well as the Fair Trade Commission (FTC) and the Justice Department Antitrust Division.

By contrast, automotive firms and other steel consumers gathered at the prestigious Tampa Steel Conference in February told Bloomberg that they felt much safer with the purchase by Nippon Steel.

At the root of the union’s complaints seem to be two issues, both eminently solvable. Gains of revenue in the US market would make it profitable for NS to pay what it takes to solve these problems.

The first is fear by the union that, like the USS management, NS would seek to shut down the unionized blast furnaces or sell them off. Instead, It would rely completely on electric arc furnaces located in non-union states. Indeed, in its first effort, NS bid only for those electric arc plants. It bought the blast furnaces as well when USS stated that it was an “all or nothing” purchase. Now, however, NS says, “We do not intend to shut down any of US Steel’s blast furnaces as a result of this transaction. We look forward to bringing fresh investment and innovation into US Steel’s existing blast furnaces to help drive our collective decarbonization efforts and overall efficiency.” A re-elected Biden could even sweeten the deal by allotting some Inflation Reduction Act money to help finance work on decarbonizing the blast furnaces.

Secondly, relations between the union and the current USS management are so acrimonious that NS needs to make peace with the union simply to guarantee smooth operations of the unionized mills. The USW completely distrusts USS management and feared that NS would use the current managers to run the facilities. NS needs to convince the union that it will use new managers and that it has a very different attitude than USS. NS has said many of the right words on thorny issues like the blast furnaces, no layoffs, maintaining the terms of the union contract, and so forth. But the USW complains that NS takes the attitude of “trust us.” It wants guarantees. The question is whether NS is prepared to provide enough guarantees to satisfy the union—and in time to avoid blockage by Donald Trump. It’s in the interest of both parties to find a way to make the deal.

As you alluded to, it seems that the proposed acquisition of USS by NS would fit well with the "friendshoring" policy goals of both allies.

In order for NS representatives to make a deal with USW, what kinds of concessions are likely to be necessary?