Source: Based on WSJ data

FLASH: METI Minister Fails to Gain Tariff Exemptions

Reuters reported, “Japan's trade minister said he had asked the United States not to impose trade tariffs on his country, but did not win any assurance that Japan would be exempt.” Trump’s 25% tariffs on steel, and semiconductors started March 12; autos come on April 2. Yoji Muto met in Washington yesterday with Secretary of Commerce Howard Lutnick, U.S. Trade Representative Jamieson Greer, and White House economic adviser Kevin Hassett. As I reported in a previous post, Tokyo’s posture on Donald Trump’s tariff war was not to ally with other victimized countries, but to try to placate him to gain exemptions.

-

Diverging Pressures Afflict Yen

Hurricane Trump—Donald Trump’s chaotic maelstrom of contradictory actions—is simultaneously putting upward and downward pressure on the yen. On the one hand, the drop in American interest rates caused by fears of a recession has put upward pressure on the yen’s value from ¥156 on his inauguration day to ¥147 today. On the other hand, his trade wars have put downward pressure on the yen, preventing it from moving to ¥133-139, as past financial patterns in American and Japanese interest rates would have predicted. Consequently, while the Bank of Japan (BOJ) has some power to influence the yen's value, that power is limited.

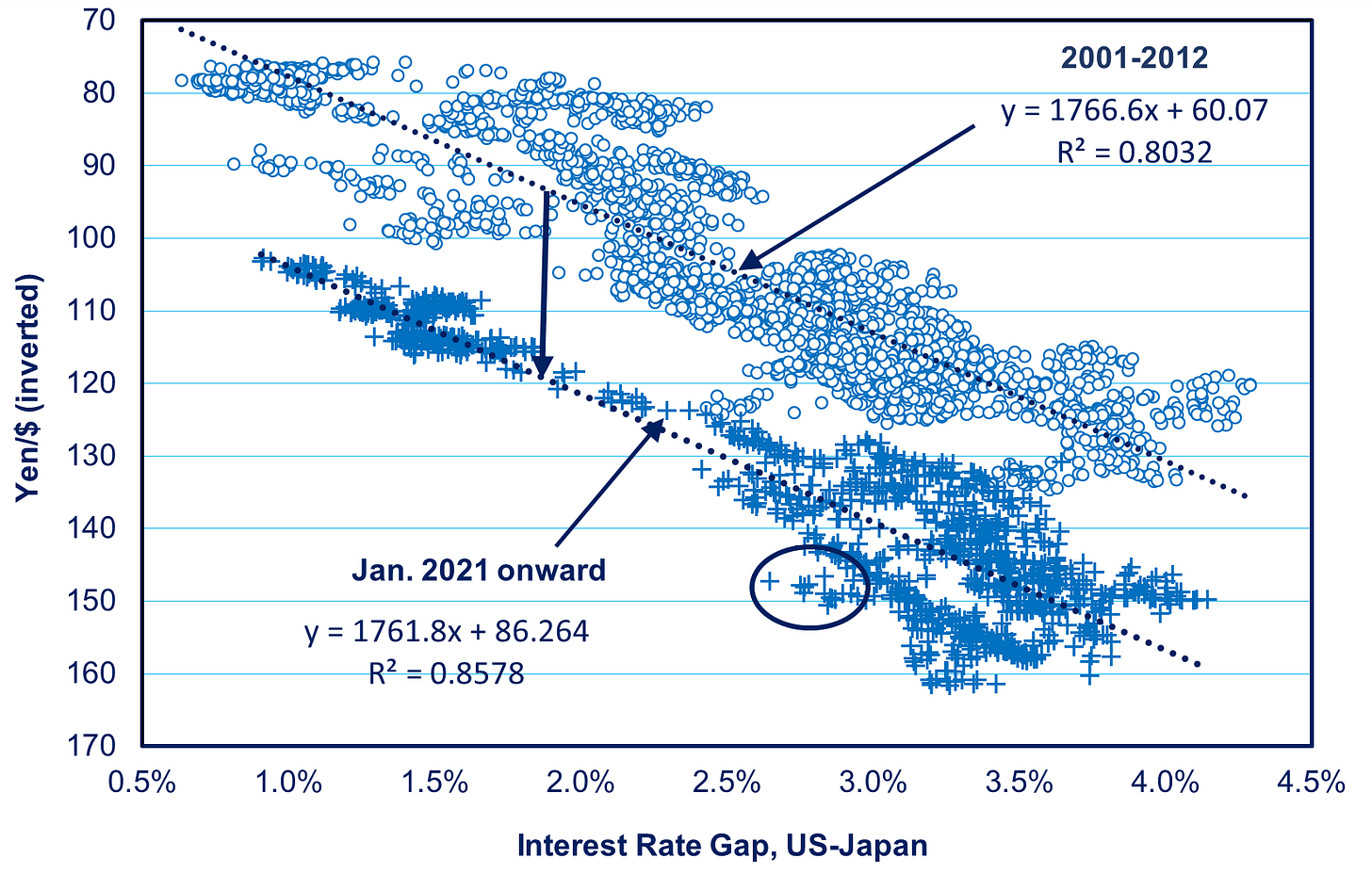

During 2001-12, and again during 2021-25, the gap between American and Japanese interest rates on 10-year government bonds has been a surprisingly good predictor of the yen’s value. Money flows to where it can earn the most. The higher American rates are relative to those in Japan, the more money flows from Japan to the US. That leads to a sale of yen and, thus, a decline in its value. As we can see in the chart at the top of this post, in the period between August 2024 and mid-February of this year, there was a very tight linkage between the ups and downs of the rate gap (the blue line) and the value of the yen (the darker line). The scale is set so that, when the lines move upward, the rate gap is narrowing, and the yen is becoming stronger.

And yet, since mid-February, the paths of the rate gap and the yen (the two lines in the chart at the top) have sharply diverged. Even as the interest rate gap has narrowed to the smallest gap since August 2022, the yen only recovered to ¥147, whereas back in 2022, that rate gap was accompanied by a yen of around ¥133 (see oval areas in the chart below).

Source: Forecast is author calculation based on the interest rate gap

If the yen were following the pattern since last August—when the yen had ratcheted down—today’s rate gap would translate into a yen around ¥139/$.

Hurricane Trump

The immediate trigger for the diverging path is the storm of chaos let loose by Donald Trump’s sledgehammer-like trade wars and mass firings of government employees—such as the firing of bird flu scientists at a time when bird flu makes it hard to find eggs in the store.

On one side, some actions by Trump created upward pressure on the yen, mainly actions that end up causing US interest rates to fall. The main factor is that Trump’s chaos has somewhat raised the odds of a recession over the coming 12 months. JPMorgan Chase raised the risk from 30% to 40%, saying, “We see a material risk that the US falls into recession this year owing to extreme US policies.” Goldman Sachs raised the odds from 15% to 20%, naming Trump’s economic policies as the “key risk.” While the likelihood of recession is still small, that fear has sent the stock market tumbling a bit more than 10%, a state called “correction territory.” More importantly for the yen, that has also pushed 10-year interest rates in the US downward at a time when Japanese rates are rising. Part of this is due to an expectation that the Federal Reserve will cut interest rates in June to prevent such a recession. Two-thirds of the decrease in the US-Japan interest rate gap has been due to the fall in American rates rather than rising rates in Japan. As noted above, the yen strengthens when the interest rate gap decreases.

On the other side, Trump’s trade war and rages against Japan are pushing the yen downward. This is because his trade war is likely to lead to a decline in Japan’s trade surplus, and a declining surplus makes the yen weaker. (If other countries import less from Japan, that decreases demand for the yen with which to buy then, and thus a decline in the yen’s value.)

Trump has declared his 25% tariffs will start tomorrow (although he has previously delayed such tariffs at the last moment in a series of “mind games”). The three products combined comprise 37% of Japan’s exports to the US. Automotive products alone comprise a third of all Japanese exports to the US and 20% globally. The US is Japan’s biggest customer, buying 20% of all Japanese exports in 2024. As a result, exports of these three products to the US comprise 7.5% of all Japanese global exports.

Beyond that, Japan will be hit hard by Trump’s trade war against Canada, Mexico, Europe, China, and others. That’s because so much of its exports to these countries serve as machinery and parts for their own exports to the US.

Moreover, as is Trump’s habit, he has no hesitation to lie when he believes it will help his cause. One of his latest is accusing Japan of pushing the yen down, when, in fact, beginning in 2022, it has spent several percent of GDP on interventions in the currency market in a failed attempt to elevate its value. Trump told reporters, “I’ve called President Xi (Jinping), I’ve called the leaders of Japan to say you can’t continue to reduce and break down your currency...“It's very hard for us to make tractors, Caterpillar here, when Japan, China, and other places are killing their currency, meaning driving it down.”

Temporary Gyration or Longer Term Harbinger?

Trump has shown he is quite willing to raise the ante when victims of his trade war retaliate, e.g. China and Canada—even at the risk of provoking a US recession. So, who knows how far this trade war will go or how long it will last? Will this become a permanent change in US policy? Keep in mind that, after Trump levied steel tariffs against America’s allies in his first term, calling them national security threats, Joe Biden refused to lift them. Instead, he used them as bargaining chips.

That makes it hard for even the best professionals to project where the yen will go over the medium term. What is clear is that any trade war adds to the decades-long downward pressures on the yen. Over the long haul, the yen’s depreciation is not caused by the interest rate gap alone but by the deterioration of Japan’s competitive fundamentals, as I most recently discussed in this post.

To put today’s movements of the yen into its long-term context, consider the chart below. It’s one I’ve run before and keep updating. There are two trend lines, the higher one for 2001-12 and the lower one covering 2001-25

.In each of the two periods, for each percentage point widening or narrowing of the interest rate gap, the yen/$ has moved down or up 17 points, e.g., from 130 to 147. But notice how far below the 2001-12 trend line is the one for 2021-25. For any given interest rate gap today, the yen is 26 points weaker than two decades ago. In the past month, the rate gap has narrowed to 2.6 percentage points. Back in 2001-12, that would have led to a yen rate fluctuating around ¥106. Today, it would mean one fluctuating around ¥133 if past patterns prevailed. The yen is weaker because the Japanese economy is weaker.

Today, however, the yen is far weaker than its predicted value: 14 points weaker at ¥147 instead of ¥133 (see the markers surrounded by a circle below the lower trend line). Only time will tell whether this is a period of temporary outliers or the beginning of a more lasting ratchet downward.

If the economy continues to weaken because of homegrown problems and the trade war continues to hurt Japan’s exports, the yen will continue to weaken. Manipulating interest rates cannot correct these problems.

Coming in a future post: In a future post, the role of financial flows in the deterioration of Japan’s fundamentals. They now have an even bigger impact than trade flows.

To receive new posts and support my work, consider becoming a free or paid subscriber.

To provide more support, donate several subs at $50 each. You do not need to name the sub recipients, just how many. This is a one-time contribution; it does not repeat automatically. Please click the button below.

Bessent is not one dimensional--the driving fundamental in 22/24 was the carry trade during times of interest rate chaos---coming to the end of the predominance of carry so a different fundamental may be of greater interest----Germany was a clssic example last Thursday as the BUND rose 30 basis points and the DAX rallied 4%

a US admin decided the YEN was weak because of the carry trade and acted to intervene to strengthen the YEN---will Bessent act similar to Rubin and buy YEN forcing out the carry trades and thus not moving to enact Tariffs