Japan’s Vulnerability If There’s A New Recession

Ramifications for Living Standards and Geopolitics

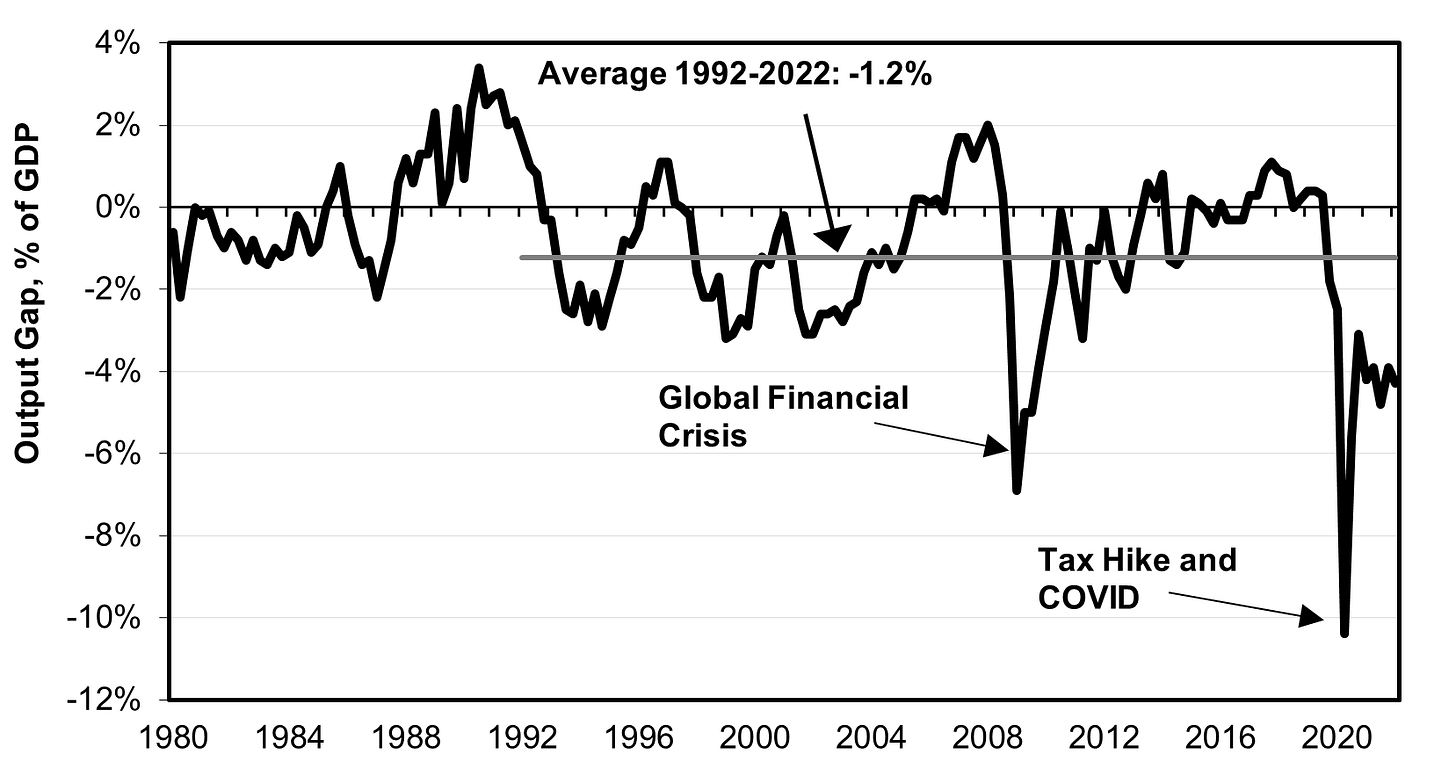

Gap between actual GDP and potential GDP at full capacity (explained in text below)

How will Japan fare if rising interest rates and the war in Ukraine send the US and Europe into a new recession? Not well, if history is any guide. It all depends on the length and depth of any recession—that is, if one even occurs. But the record shows that Japan’s economy is very susceptible to outsized reactions to economic shocks, including downturns originating elsewhere.

If history repeats itself, this will mean not only a continued decline in living standards for a large share of the population but also a geopolitical consequence. Japan’s influence in Asia will continue to erode, reducing its ability to act as a counterweight to China. The Asia Power Index reported that, in 2021, across all dimensions of power, Japan has “for the first time dropped below the major power threshold of 40 points and is now considered a high-performing middle power.” When it comes to economic relationships within Asia, i.e., “the capacity to exercise influence and leverage through economic interdependencies” like trade, investment, and technological leadership, Japan’s score fell from 56 in 2018, when the index was launched, to only 40 by 2021. By contrast, China’s score rose from 96 to 99.

Japan Takes A Bigger Hit From Global Shocks

The Japanese financial system had engaged hardly at all in the financial shenanigans that created the frightening global financial cataclysm of 2008-09. And yet, during 2007-09, Japan’s GDP tumbled far more than the rest of the rich countries in the OECD (Organization for Economic Cooperation and Development), and then recovered more slowly (see chart below).

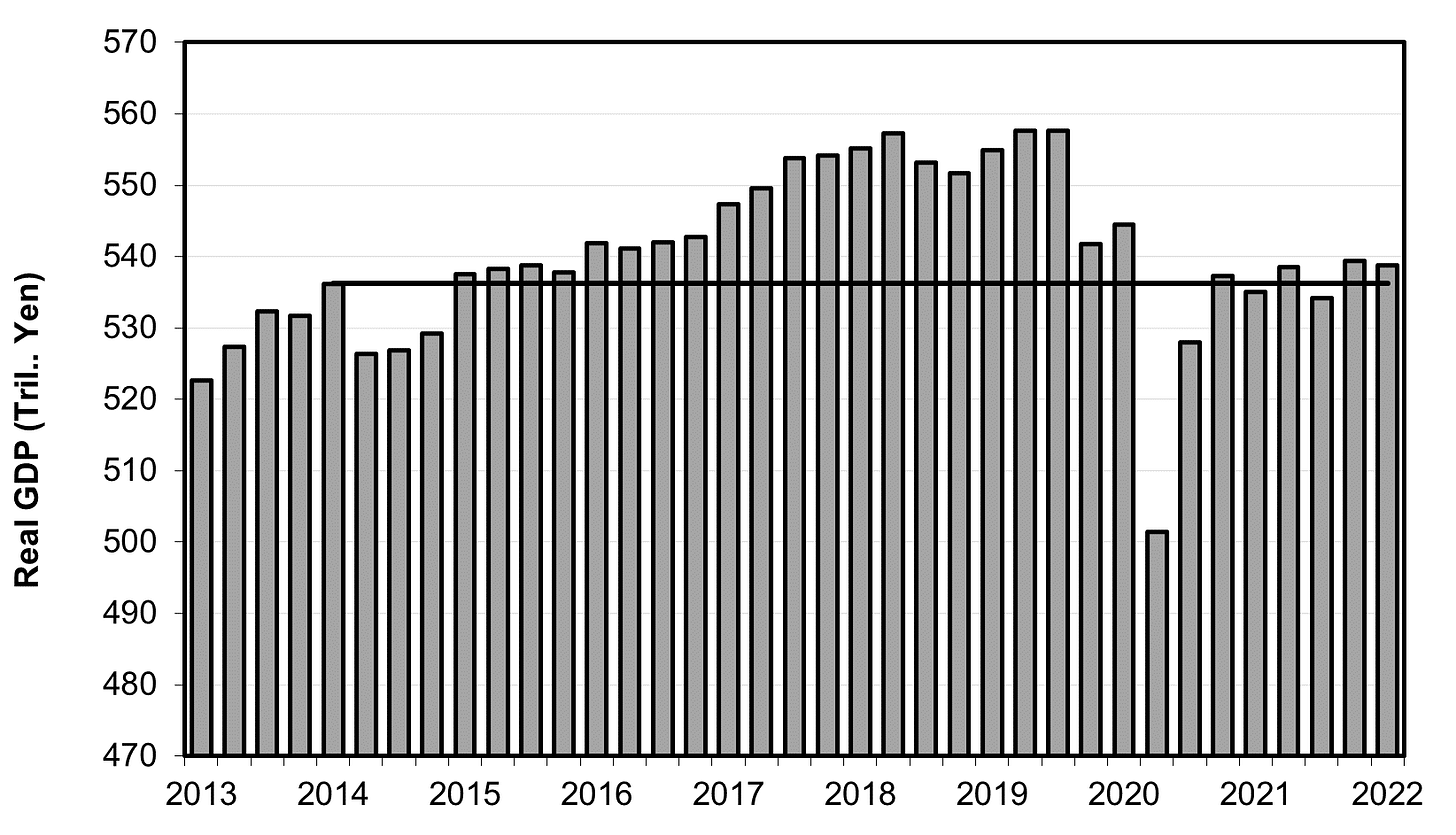

The same thing happened during COVID. Despite having far fewer cases and deaths than other countries, Japan suffered far more economically from the attendant containment measures and supply chain problems. Although Japan initially suffered a milder tumble than the rest of the OECD, its recovery has been much slower. Indeed, it has barely grown since late 2020 (see chart below).

In fact, as a result of the two hikes in the consumption tax (2014 and 2019) and COVID, Japan’s GDP in Jan-March 2022 was barely higher than it had been seven years earlier just before the first of those tax hikes (see chart below).

Why Is Japan So Vulnerable?

A pillar of modern growth theory since the 1960s is that, in order for a market economy to avoid macroeconomic instability, its growth must be “balanced,” i.e., GDP, personal income, consumption, and investment must, in the long run, grow more or less at the same pace. Japan has long since stopped doing so and the situation has gotten worse during the three “lost decades” since 1990.

Not only has GDP growth slowed, but less and less of the fruits of that growth are being spread to the population through wages, interest, dividends, pensions, etc. From 1995 to 2018, real per capita GDP grew a total of 17%, the second lowest growth in the OECD. Worse yet people got even thinner slices of this smaller pie. Median disposable (after-tax) income tumbled a considerable 11% for the seniors who now comprise nearly a third of the population. Working-age people suffered a 2% drop in disposable median income, mostly due to stagnant real wages.

This created two kinds of instability. Since poor household income translates into weak consumer demand, the economy has required decade after decade of big budget deficits and near-zero interest rates to avoid permanent recession. Secondly, the economy has lost its resilience in the face of economic shocks. Let’s see why.

In the course of a normal business cycle, actual GDP fluctuates between a level somewhat above its full-capacity potential GDP and somewhat below. When there’s a recession, reserves of pent-up demand build up among both consumers and businesses. Aided by temporary fiscal and monetary stimulus, the unleashing of this pent-up demand brings the economy back to full capacity and, over time, a bit more. As a result, on average over the course of these cycles, the economy operates at its full potential.[1]

In Japan, however, households suffer from insufficient income and, with consumer spending so weak, companies hoard cash rather than invest in expanding capacity. As a result, when Japan takes a hit, its ability to bounce back is not very strong. Over the last 30 years, Japan’s actual GDP has averaged 1.2% below its full-capacity potential (see chart at the very top). Per capita GDP has struggled at a snail’s pace of 0.6% annual growth. Even with its poor productivity growth, Japan could have grown faster if it were more resilient.

History is, to be sure, not destiny, but it does provide some clues worth heeding if the world does indeed face a new recession.

[1] Readers may wonder how an economy can operate above its full capacity. Full capacity here refers to capacity that can be used on a sustained basis without causing physical or financial strains. For example, factories cannot operate continually at 100% of capacity because machinery starts to break down and must be fixed. Nor can unemployment approach anything close to zero without causing financial strains like inflation.

Toyo Keizai ran a longer piece on this at https://toyokeizai.net/articles/-/605182 in Japanese and English.

Japanese banks tend to have very low ROA's and earn reasonable returns only through high leverage. They also never charge enough for consumer services. This means that as soon as there is stress in the system earnings crash. Once banks start to feel the pressure they are forced to cut lending in a big way. This undercuts the economy.

I couldn't locate the data, but I believe Japanese companies lag in bond financing (they are flush with cash). Once the banks stop lending the medium and small businesses start hurting...