May Wage Data Mixed: Are Shunto Hikes Spreading to Rest of the Workforce?

Real Wage Declines So far Caused Consumption to Drop For Four Quarters in a Row

Source: https://www.mhlw.go.jp/english/database/db-l/monthly-labour.html

Wage hike figures for May are giving out conflicting signals. Did the big (5%) hikes from the spring shunto negotiations spread to the rest of the labor force? Or, as in 2023, did they fail to do so very much? The shunto covers only 16% of the labor force, mostly at big companies that pay higher wages. As with the story of the blind men and the elephant, what you perceive depends on which figures you use.

There is no such problem regarding real wages, i.e., nominal wages adjusted for inflation, which fell 1.4% in May, for the 26th consecutive month (see chart at the top). That fall was the lead in Kyodo’s report. (I’ll discuss below how this has caused real consumer spending to keep dropping for more than a year.)

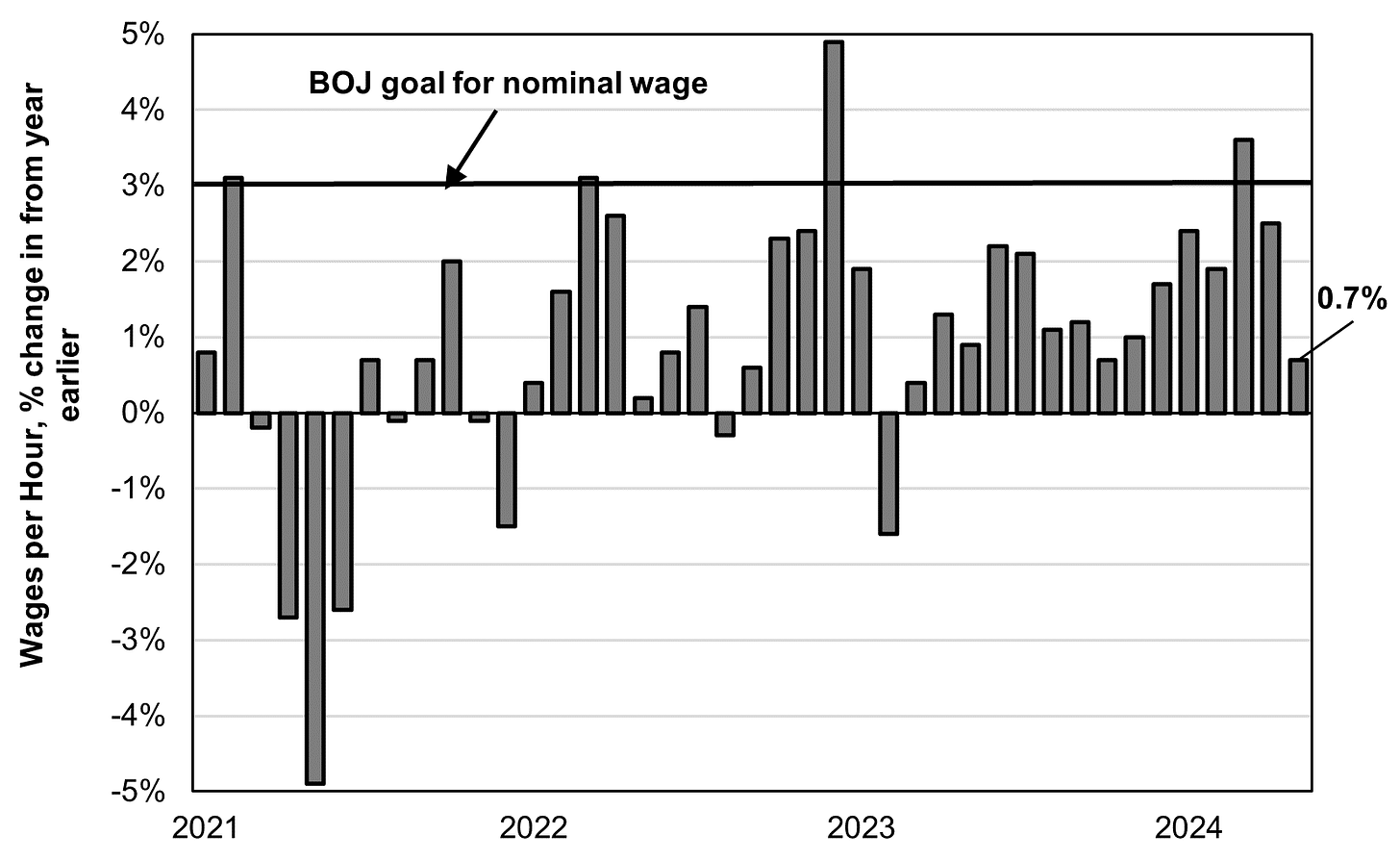

By contrast, Bloomberg headlined its article Base Pay Jumps Most Since 1993 in Positive Signal for BOJ and focused on the 2.5% hike from last May in “base pay,” i.e., pay for scheduled hours, not counting overtime, bonuses, etc. 2.5% is getting quite close to the Bank of Japan’s (BOJ) goal of sustained 3% hikes in nominal wages; the BOJ believes reaching that goal is pivotal to achieving 2% inflation. The BOJ’s faith that it is steadily reaching the 3% wage goal justifies gradually hiking interest rates.

There’s a problem with this base pay measure, however. It is not adjusted for the ups and downs in the number of scheduled hours. In May, for the first time in several months, hours rose, and by a substantial 1.3% from the year before. If we “look under the hood” at the hike in pay per hour, we get a very different picture. For scheduled hours, wages rose only 1.2% per hour; for total pay, including overtime and bonuses, wages rose only 0.7% per hour. However, as you can see in the chart below, the numbers gyrate a great deal from month to month.

. There is yet another measure that the BOJ prefers. Unlike the primary measures discussed above, this sample uses workers at the same companies, and counts only base pay, not overtime or bonuses. This measure shows an increase to 2.7% in May (see chart below), which the BOJ will undoubtedly find very encouraging.

.Source: https://www.mhlw.go.jp/toukei/list/30-1a.html

However, this measure also fails to adjust for hours worked. Moreover, the sample size is smaller and it’s not clear whether it shows the same proportion of small and large companies as is the case in the overall economy. If the sample is skewed, this could make a huge difference. For example, in the data for workers in all establishments with at least five employees, May showed a 1.9% increase in total wages (as seen in the top chart), but, for establishments with at least 30 employees, May showed a 2.5% hike.

There is one final fly in the ointment. The wage hike began to take place as of April 1st, The hikes tend to be gradually introduced over the April-June period. In 2023, according to Morgan Stanley, fewer than half the firms involved in the shunto administered those increases as of May. So, we will not get a reliable picture until at least June, or even July.

Falling Real Wages Translate Into Falling Real Consumer Spending

Before discussing what the May wage figures mean for the future, let’s look at the ramifications of falling real wages. Real consumer spending has fallen for four consecutive quarters and, given a tiny rise in April and a 1.8% fall from the year before in May, April-June could make it the fifth consecutive quarter. The BOJ reportedly expects consumer spending to grow in April-June, and only time will tell. In any case, as of January-March, spending is down 2.1% from a year earlier. Amazingly, it’s also down 4% from 2013 (see chart below)! Consumer spending per person is down 1% from 11 years ago. I don’t know of any other major OECD country that has suffered such a long-term decline in spending.

.Source: https://www.esri.cao.go.jp/en/sna/data/sokuhou/files/2024/qe241_2/gdemenuear.html

Nor is it an artifact of aging. As I reported in a previous post, spending per capita for the aged is about the same as for the population as a whole.

Rather the decline is the natural result of falling income. It’s certainly not because consumers are holding back; on the contrary, the savings rate has fallen to zero. The problem is not lack of will but lack of wallet.

Debate Over Wage Prospects

Given the conflicting data, Japanese experts are divided about what all this means for wages over the coming year and for the BOJ’s stance on interest rates.

Regarding wages, Kyodo cited Koya Miyamae, a senior economist at SMBC Nikko Securities Inc., as saying that sizeable wage hikes will spread and become visible during the next couple of months. “It appears that a ripple effect may have begun,” he said. However, an official at the Ministry of Health, Labor, and Welfare (MHLW) told the press that he was less confident because he feared that energy and food costs would keep the overall consumer price index above 2%. “Nominal pay looks set to increase in the future due to the effects of salary hikes, but without an easing off of price rises it's hard to see real wages turning positive.”

The BOJ, not surprisingly, takes an optimistic stance. It has to do so if it is to justify its efforts to normalize monetary policy. In any case, as the result of a quarterly meeting of regional BOJ officials, the BOJ reported on July 8, “Many regions reported that big firms’ big pay hikes in this year's wage negotiations were spreading to small and medium-sized companies.” Some smaller firms decided to prioritize raising pay to retain or hire workers, even if they were not earning sufficient profits. Moreover, “for firms, higher wages mean higher costs. Some of them are starting to pass on the cost by raising service prices.” The regional branch managers said household spending was “firm as a whole.” That’s hard to square with the just-released report that consumer spending fell again in May reported above.

BOJ watchers have been wondering what the wage data means for whether the BOJ will hike interest rates at its July 31st meeting. Bloomberg Economics economist Taro Kimura argued, “Along with signs that inflation is also going the right way, we think the reading will give the Bank of Japan strong confidence that the wage-price cycle is starting to spin — and give policymakers a nod to hike rates at the July meeting.” Still, Bloomberg reported a contrary view from Toru Suehiro, chief economist at Daiwa Securities. “The BOJ isn’t going to refer to just one month’s data, so the impact of this result on the central bank’s decision will limited...Private consumption figures are still weak and that needs to be closely watched, making a rate hike in July difficult.” Reuters cited Masato Koike, senior economist at Sompo Institute Plus, as saying, “The BOJ has been saying all along that consumption is firm. Today's data [the 1.8% fall in consumer spending] could force the bank to alter that view and make it difficult to justify a rate hike in July.” About one-third of economists predict a rate hike at the July meeting.

Wages, Spending, and Inflation

The BOJ argues that sustained nominal pay hikes of 3% will create 2% inflation. The theory is that, with productivity rising at 1% a year, labor costs will rise by 2% and companies will be able to pass those increased costs on to consumers. That’s a view of wages that focuses only on the supply side of the occasion. That’s like saying that scissors can cut with only one blade. Rising costs will increase companies’ desire to pass on the costs. However, their ability to do so depends on real demand by consumers and companies. If real wages and consumer spending continue dropping, that’s going to be hard. And, if companies cannot pass on those costs, the prospects will dim for continued wage hikes at this year’s level.

On some days on amazon.co.jp