Nippon Steel Is “Canary In The Coal Mine” Of US Protectionism

Why Blue-Collar Workers In US Turned to Nationalist Populism

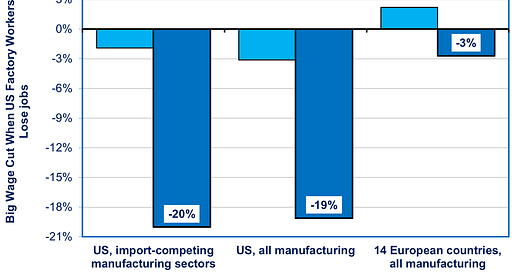

Source: https://www.oecd-ilibrary.org/content/publication/empl_outlook-2005-en Note: US during 1979-1999 and Europe during 1994-2001; see text for explanation

At Nippon Steel’s recent annual meeting, executives minimized the political obstacles to its purchase of US Steel. Executive Vice President Takahiro Mori told anxious shareholders, “Once the US presidential election is over, the political aspect will disappear.” Another executive discounted both President Joe Biden’s disapproval and Donald Trump’s vow to “absolutely” block it “instantaneously.” Based on wishful thinking that this is just election-year politics in battleground states (Pennsylvania and Ohio), this executive declared: “No matter which candidate becomes President, they will probably take a calm view...after the election.”

It is certainly true that the election year gives more leverage to the United Steelworkers Union (USW). Still, this union has inordinate political power even in non-election years and even when its demands hurt the overall economy. For example, while the US has 140,000 factory workers in steel, it has a million in vehicles and parts. Still, in 2018, Trump raised import tariffs on steel, tariffs that Biden mostly maintained. GM and Ford each said the tariffs would add a billion dollars per year to their costs, hurting their competitiveness and jobs. They also raised costs at Caterpillar tractor and Whirlpool appliances, which together employ 173,000, more than all of steel. Overall, the Trump-Biden tariffs on steel and aluminum destroyed an estimated 376,000 jobs in the rest of the economy—46,000 of them in manufacturing—in order to boost steel and aluminum jobs by just 26,000.

It’s also true that Trump is notorious for changing his mind when it will benefit him. So, to help the merger go through, Nippon Steel recently hired Mike Pompeo, Secretary of State in Trump’s first term and someone who can still get Trump on the phone. Yet, Trump’s economic nationalism is one of the few areas where he is guided by deep emotions. He proclaimed, “U.S. Steel is being bought by Japan. So terrible.” Note that he said “Japan” rather than a Japanese company. It’s telling that he chose Senator JD Vance of Ohio, a strident opponent of the merger, as his Vice Presidential nominee. One indicator will be how much Trump and Vance repeat their rhetoric against Nippon Steel in the coming months.

The bottom line is that opposition to the steel merger is not an isolated issue, but one of many “canaries on the coal mine” that indicate growing protectionism and nationalism among voters and politicians in both American parties.

The Best Chance for Success: Binding Arbitration With the USW

Despite these broader trends, there is still a chance of the merger going through if Nippon Steel can secure an agreement from the USW and Kamala Harris wins the Presidency. If the USW approves, both the White House and Democratic members of Congress who now oppose the merger would likely change their minds.

Up to now, the USW has adamantly opposed the merger. Worse yet, after one initial meeting in the US with Mori, the union has refused to hold any further talks. However, there’s an opportunity for a possible breakthrough: binding arbitration between the steel companies and the union beginning on August 15. If a three-person arbitration panel says the deal can go through as long as Nippon Steel provides remedies for the union’s legitimate complaints, both sides must comply. The decision could come as early as a few weeks or so after the hearings.

There are two issues at stake. Firstly, the USW contends that it was excluded from the bidding process in violation of its contract with US Steel. However, USW had assigned its bidding rights to Cleveland-Cliffs, another American steel company. Nippon Steel outbid that company. If the arbitrator sides with the union and does not propose a remedy, this could jeopardize the acquisition.

Secondly, the USW insists that Nippon Steel guarantee adherence to the existing labor contract. Nippon Steel has promised to do so, but the union contends that assorted “loopholes” make its pledges worthless. For example, Nippon Steel promises no layoffs during the contract's life, which runs until September 2026. However, a draft of the steelmaker’s proposed agreement says it could abandon that pledge if there is an “unanticipated or significant downturn in business conditions.” If the arbitrators say the union has valid complaints, then they are expected to specify remedies that both sides must accept. Then, the merger could go through. Once the union accepted it, the Biden administration’s national security review would also likely approve it once the election is over. Biden has given himself an out, never having called the deal a security threat, only saying that it needs to be looked into.

Why White Working-Class Voters Bought Trade War Nostrums

Why has an ordinary cross-country merger become such a contentious matter? It’s because decades of job and income losses have driven many working-class white voters who used to vote for Democrats to flock to anti-globalization populists like Trump. To win these voters back, Biden and many Democrats in Congress have adopted similar stances on trade and even some cases of foreign acquisitions of US companies. There is a similar pattern in Europe.

The decline of manufacturing jobs from 20 million in 1979 to 13 million today—from a third of all private jobs in 1960 to just one in ten today—has wreaked havoc on blue-collar workers and their communities. Since similar trends have also occurred even in trade surplus countries, parallel political consequences exist.

Source: http://data.bls.gov/cgi-bin/surveymost?ce

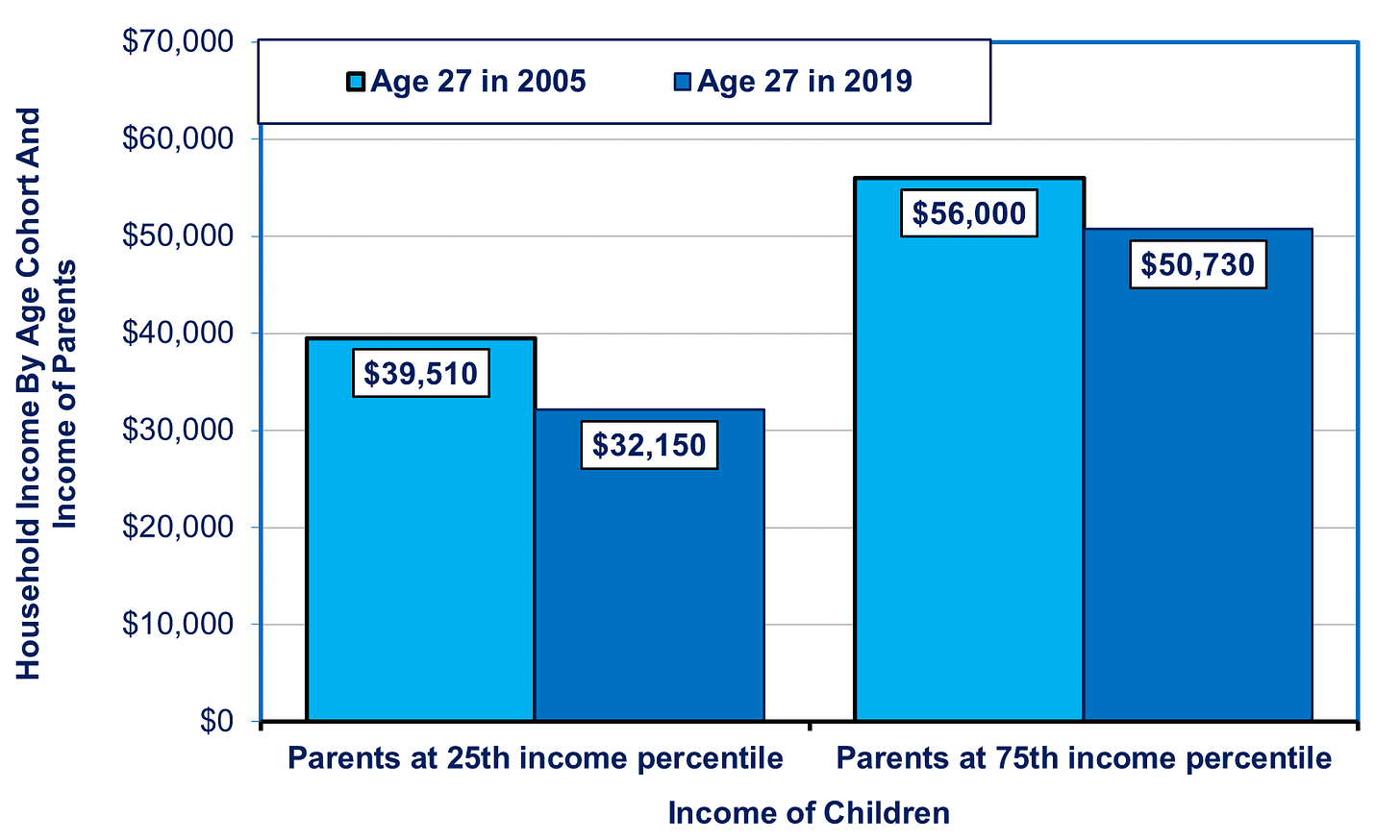

Consider two white children born into families at the 25th percentile of household income, one born in 1978 and the other in 1992. At age 27 (2005 and 2019), the first would have a real household income of $39,000. The income of the second would be a stunning $7,000 (18%) less, just $32,000. Even those born into upper-middle-class families at the 75% percentile show a 10% drop in household income when we compare the two age cohorts (see chart below).

Source: https://opportunityinsights.org/wp-content/uploads/2024/07/ChangingOpportunity_Paper.pdf

In both cases, the biggest immediate cause is stagnation in individual incomes combined with a drop in marriage rates and, thus, the number of two-income households (see chart).

But, if we look at the root causes, the biggest factor in the drop in marriage rates and household income is the change of employment rates of parents in their community. We can see in the chart below, as the county-wide employment rate of parents went down, so did the income of their children when we compare those born in 1978 to those born in 1992. In so many counties, the percentage of white parents at the 25th income percentile with jobs plummeted by as much as 5 to 15 percentage points. As that happened, the income of their children at age 27 dropped into lower income classes by as much as 4 percentile points, a difference that can translate into an income drop of $5,000. A chart of children’s marriage rates and county-wide parental employment would look very much the same.

So, as the loss of factory jobs hollowed out communities, this had lasting effects on jobs, income, marriage rates, and even lifespan, into the next generation. Growing desperation makes “Make America Great Again” sound attractive, and many voters still continue to “grasp at the straw” of belief in MAGA even when its promises prove hollow.

Nowhere is this trend greater than in the “rust belt” states of the US Midwest, where most unionized factory workers once reliably voted for the Democrats. For example, between 2000 and 2015, auto jobs fell by 30%. The leading cause was technology and automation. In 2015, vehicle and parts makers only needed one worker to produce as much value as required two workers in 2000. Even if the US had imported not a single auto or auto part, jobs would still have fallen 27%. Moreover, employers cut real wages for the remaining autoworkers by 10% during this period.

Making matters worse, unlike most rich countries, the US (and Japan) invested very little in retraining, job-matching, and other “active labor measures” (see chart).

Source: OECD at https://tinyurl.com/5n8zm8dv

Active labor measures are very effective in reducing long-term unemployment and avoiding big wage cuts, as well as in reducing the share of middle-class workers suffering downward mobility. The lack of such measures is one reason that, when American factory workers who lost their jobs were forced to shift to service jobs, their wages plunged by 20%. That was true whether their job had been lost to imports or technology. But their wages barely dropped when their new job was in the same manufacturing subsector. Once again, whether or not there was competition from imports made little difference. In Europe, by contrast, factory workers who had to move to service jobs or other manufacturing sectors suffered only a 3% wage cut (see chart at the top of this post). Political policies, not pure economics, explain the difference. That’s why promises to revive manufacturing gain votes.

Workers victimized by these economic trends throughout the US and Europe looked for scapegoats. When blue-collar workers who traditionally voted left of center lost jobs to machines, they didn’t want to blame impersonal forces like automation. Instead, they sought more personal and malevolent culprits, like immigrants and imports boosted by “unfair” practices. In 2016, Trump’s demagoguery massively won the votes of such people. Hillary Clinton didn’t help herself when she acted as if she did not care about factory workers. Dismissing the advice of Bill Clinton, she didn’t even step foot in the big rust-belt states of Wisconsin or Michigan. The Democratic leader in the Senate, Charles Schumer, notoriously declared, “For every blue-collar Democrat we lose in western Pennsylvania, we will pick up two moderate Republicans in the suburbs in Philadelphia, and you can repeat that in Ohio and Illinois and Wisconsin.” Had Clinton won just a tiny 79,000 more votes in Wisconsin, Michigan, and Pennsylvania, she would have been the one moving into the White House. Instead, among white voters without a college degree, Trump beat Clinton by a massive 64% to 28% nationwide, and won five pivotal rust-belt states.

More and More Canaries

From 1940 through 2012, not a single Presidential nominee of either party was a protectionist on trade and foreign direct investment. Both political parties believed the lesson of the 1930s Depression and World War II was that open trade made the world more stable and prosperous, and the US more secure. Hence, both parties agreed that the US should promote free trade and investment in order to foster prosperity and stability. But, from the 1980s onward, both parties failed to take care of those injured by either trade or technological changes at home.

How things had changed by 2016, when both Trump and Hillary Clinton campaigned against free trade agreements, including the Trans-Pacific Partnership (TPP). Moreover, Clinton claimed to have opposed the NAFTA (US-Canada-Mexico) pact pushed through by her husband but blamed by rust-belt workers for their job losses. Moreover, while the Obama administration promoted TPP, it demanded concessions from other countries but offered very few itself. The US was rapidly losing its capacity to be a “benign hegemon,” at least in economic affairs. And, if the US abandons Ukraine, in security affairs as well.

Since then, things have gotten only worse. It’s not just the Trump and Biden tariffs on allies. Like Trump before him, Biden issued an executive order that increases “Buy American” provisions in federal procurement, which amounts to 10% of US GDP. This violates international agreements on nondiscrimination in procurement. While neither Trump nor Biden were the first Presidents to flout international rules, Biden increased the severity. And Democrats in Congress pushed him to go even farther than he initially intended. In the end, Biden raised the domestic content standard for a product from 50% to 75% while also increasing the degree of price favoritism for products with high domestic content. At the same time, Biden applied $1.8 trillion in new industrial subsidies and spending for infrastructure, computer chips, renewable energy, and electric vehicles, all with more onerous “Buy American” provisions. Though some of these measures were rationalized by pointing to the competition with China, they also penalized America’s friends and allies.

This is the context in which Nippon Steel is being labeled a “national security threat” when, in reality, the merger would strengthen the US economy and, therefore, national security. Sad to say, this is not an election-year exception but a sign of the times.

On some days on amazon.co.jp

I come to many of the same conclusions in my essay on the deal while also highlighting China’s dominance in steel as a reason American steelmakers need to embrace international cooperation instead of avoiding it: https://open.substack.com/pub/thestupideconomy/p/a-protectionist-mountain-out-of-a?r=i7v1h&utm_medium=ios

This all makes sense. But the underlying forces are the intelligence and dynamisms of the Chinese and on the other hand the ability to print the medium of international exchange so that the printer doesn't need to earn his keep. The forces that would have enabled the US manufacturing industry to compete, via a depreciation in the US dollar were unable to manifest. This is ultimately the payback for Nixon's abandonment of the gold standard.