Source: Bureau of Economic Analysis https://tinyurl.com/46434kvn Note: See explanation below

Donald Trump and his acolytes may not be smoking something. But they are certainly living in a pipedream. In their fevered visions, America has eliminated its trade deficit, and this has doubled factory jobs. The real problem is that they’re forcing everyone else to live in the same dream. Their efforts to make their futile dream come true could cause a severe recession.

Trump’s goal is to double the number of factory jobs to 20% of all jobs, because this is the share in Germany. He thinks he can do this by bringing the trade deficit to zero. He imagines that, if America cuts its imports of cars, machinery, semiconductors, consumer goods, and so forth, then manufacturers will make these things in the US. In reality, even if the trade deficit disappeared, there is no way factory jobs will double. I’ll explain the reasons in the next post, but the short answer is that manufacturing already suffers a big shortage of skilled labor, including indispensable engineers. But first, let’s see why Trump cannot bring the trade deficit to zero without causing a very serious recession.

Trade Deficit Shrinks Most When US Growth Slows or Goes Into Recession

Trump believes that the bigger America’s trade deficit, the slower American growth, particularly manufacturing growth. Actually, the reverse is true. America’s trade deficit is highest when America is growing rapidly and is smallest when America is in recession. When the US is at full employment and growing well, its imports grow faster than its exports, causing the trade deficit to expand. Conversely, the deficit shrinks when the economy slows and unemployment rises. That’s because, when both consumer spending and business capital investment slow down, the country needs fewer imports, and they fall faster than exports.

A look at the data for the past 60 years proves the point (see chart at the top of this post.) Between 1965 and 2024. GDP grew fastest in the eight years when the trade deficit worsened by at least 0.5% of GDP, e.g., expanding from 2% of GDP to 2.5%. In those years, GDP growth averaged 4.5% per year. Of course, the worsening trade deficit did not cause the economy to grow faster. Rather, faster GDP growth led to more rapid import growth. The second fastest growth came in the 30 years when the trade deficit worsened between 0% and 0.5% of GDP. In those years, GDP growth averaged 2.9%. Conversely, the trade deficit shrank when GDP growth slowed. The deficit shrank between 0% and 0.5% of GDP when growth averaged only 2.2% per year. And the slowest growth was in the eight years when the trade deficit shrank by more than 0.5%: average GDP growth of just 1.5%.

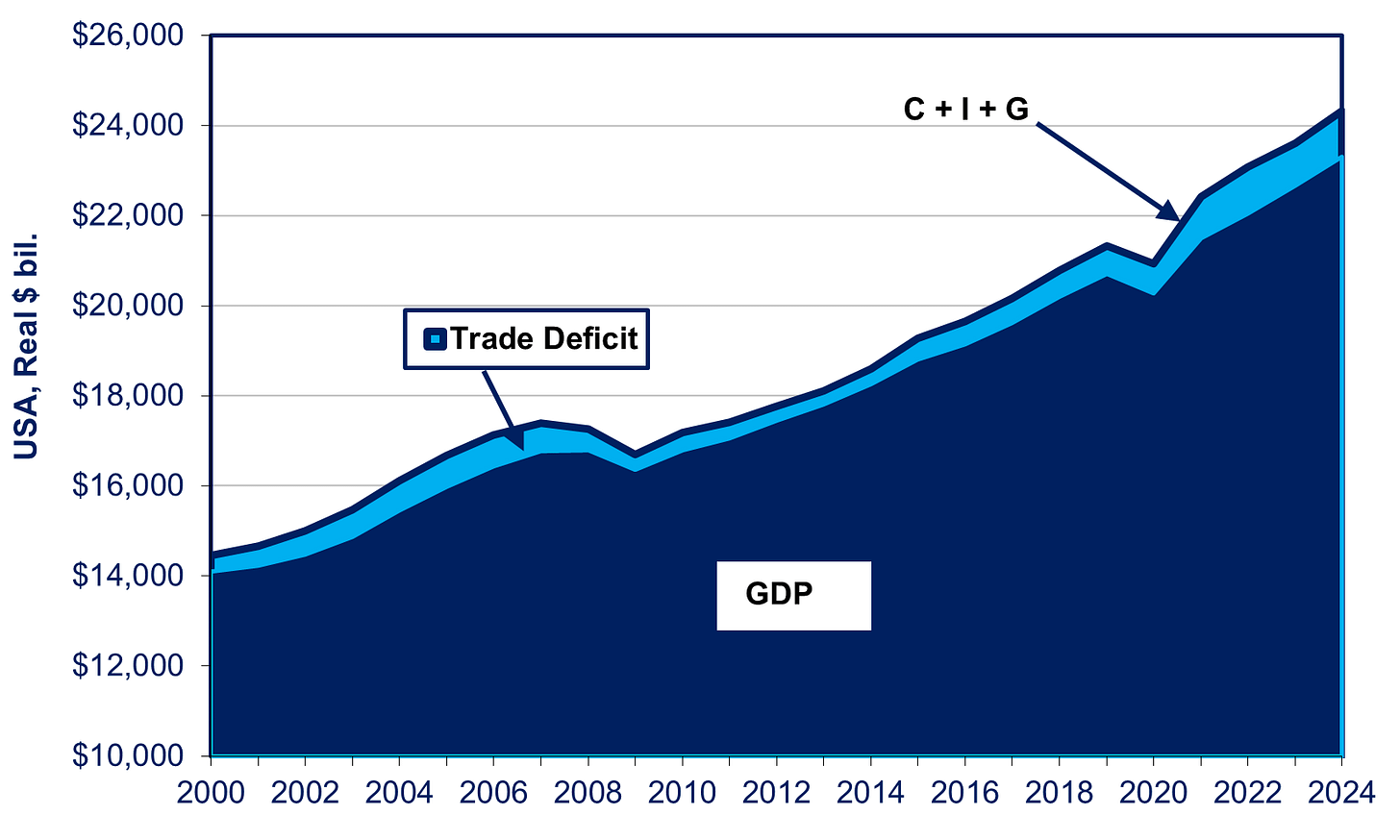

Today, the trade deficit stands at 4.5% of GDP (see chart below).

So, to bring the deficit to zero, as Trump desires, think of how much GDP would have to drop. The biggest multi-year drop in the trade deficit came in the Great Recession years of 2007-2009. This was the worst recession since the 1930s. Unemployment rose to 10%. Even then, the deficit shrank by “only” 2.3% of GDP—half the shrinkage that Trump is now trying to achieve.

Why It Would Take a Severe Recession to Eliminate America’s Trade Deficit

The MAGAites contend that the only reason America runs a trade deficit is because of “cheating” by other countries. They point to high tariffs, undervalued currencies, and assorted non-tariff barriers. In a 2017 paper, Trump trade advisor Navarro and Commerce Secretary Wilbur Ross tried to sell this “snake oil” in the following way: “According to textbook theory, balanced trade among nations should be the long-term norm, and the chronic and massive trade deficits the US has sustained for over a decade simply should not exist. This textbook state of balanced trade would exist because freely floating currencies would effectively adjust differences in national domestic cost structures to bring about balanced trade.”

If that were true, then simply removing assorted trade barriers would eliminate the deficit and cause manufacturing output to soar. However, I don’t know of a single reputable textbook that says what Navarro and Ross claim that they say.

Let me go through what the textbooks actually say. This will make it clear why it would take a recession to eliminate America’s trade deficit.

If there were no trade, a country could only consume what it produced, i.e., its GDP. Just like a person unable to borrow could not spend more than his income. For the economy as a whole, consumption in this broad sense means the sum of personal consumption (C), business capital investment (I), and government spending (G). (The latter refers to direct government spending on the stuff it buys and the wages it pays employees. Purchases deriving from transfer payments like Social Security and Medicare show up in household consumption.)

Foreign trade is what allows a country to consume more than it produces. Look at the chart below regarding the USA. We can see that every year, the sum of C, I, and G is a few percentage points greater than GDP. The only way to do that is by importing the extra goods and services that the US cannot produce even at full employment. The US has to borrow from the trade surplus countries to pay for those extra imports; that borrowing comes in the form of purchases of US Treasury bonds or investment in corporate stocks and bonds, among other things. The size of the trade deficit is exactly equal to the size of the gap between what the US produces (GDP) and what it consumes (C+I+G). In the chart below, GDP is the dark blue area, C+I+G is the dark line at the top, and the gap is the light blue area

.Source: Bureau of Economic Analysis

So, the only way to eliminate the trade deficit is to prevent consumption from being any higher than production. GDP itself cannot be raised enough to fill the gap since the economy is already at full employment. As noted above, a 4.5% reduction in the deficit is twice as big as that suffered in the 2007-09 Great Recession. Worse yet, reducing the 4.5% gap between GDP and C+I+G requires a bigger reduction in GDP than the initial 4.5%. That’s because, when purchases slow, they also slow for domestically produced items, not just imports. In the Great Recession of 2007-09, GDP had to fall 4.3% just to reduce the trade deficit by 2.3% of GDP. So, imagine the recession it would take to eliminate a trade deficit equal to 4.5% of GDP.

Raising tariffs, and thus prices, to sky-high levels will surely hurt consumer spending, and we may see this within a few months if Trump fully implements his 25% tariffs on autos and auto parts. It will also make American companies less competitive on world markets and thereby hurt exports (which, of course, makes it even harder to reduce the trade deficit). We may also see it if Elon Musk succeeds in throwing millions off the Social Security, Medicare, and Medicaid rolls. Companies will invest less if they see a fall in consumer spending. Of course, any “progress” in reducing the trade deficit could be offset by falling exports if foreign countries retaliate, and the world suffers a spiraling trade war between the US and some its victims. Japan, for now, wants to take a low-profile in the hope of placating Trump. Worse yet, once such tumbles start, they build on themselves through the so-called multiplier effect.

Even though Trump now says suffering a recession is worth it to boost manufacturing, once the economy starts plunging, so will Trump’s political support. He will face a lot of pressure to relent. And the 2026 elections could show a spectacular backlash. Who knows how he’ll react?

What About Surplus Countries

If excess demand relative to GDP causes some countries to run trade deficits, why do others, like Germany, run chronic trade surpluses? It’s because the surplus countries have insufficient domestic demand to purchase all that they can produce. C+ I+G is less than GDP. Hence, the only way for them to maintain full employment is to sell the excess output overseas. Their trade surplus is exactly equal to the gap between what they produce (GDP) and the much lower amount of what they consume at home (C+I+G). In this chart about Germany, C+I+G is the dark blue area at the bottom, GDP is the line at the top, and the gap between the two is the light blue area in between

Source: World Bank

Source: Cabinet office at https://www.esri.cao.go.jp/jp/sna/data/data_list/sokuhou/files/2024/qe244_2/tables/gaku-mcy2442.csv

This part is a little wonky. But for those who are intersted, bear wiwth me. The chart above chart shows Japan’s the balance of GDP, broad consumption, and the trade balance in constant 2000 yen. However, due to the huge depreciation of the yen, Japan now runs a trade deficit in nominal terms. In other words, it is exporting than it imports in real terms but it is getting fewer yen for each export item and is paying more yen for everthing it imports. This is due to both a loss of competitiveness for its exports and high prices for imports (see this post). The chart below shows how Japan turned from a suplus to a deficit country in nominal terms. C+I+G (light blue area) has grown not so much because of real growth in personal comsumption, business investment, but because of the high prices caused by yen depreciation. I can discuss this more in a future post.

Countries can affect the size of the surplus or deficit by carrying out policies that affect the value of their currencies, by the use of tariff and non-tariffs barriers, interest rates, etc. However, there is a limit to how much effect such policies can have unless they change the fundamental balance between demand and supply, i.e., GDP and C+I+G. Measures aimed at improving the trade balance can also temporarily boost growth if the economy is operating below full employment, for the same reason that fiscal stimulus can help. But the US is at full employment and, aside from Covid, has been there for some time.

The Big IF

I am not predicting recession; I’m no forecaster. What I am saying is that IF Trump raised tariffs and other barriers enough to reduce the trade deficit by several percentage points of GDP, that would lead to a recession. The problem is that Trump and his sycophants have no idea of the consequences of their actions. So far now, they are plowing ahead. However, once those consequences begin to manifest themselves and a political backlash ensues, it remains to be seen whether or not Trump will relent.

NEXT: In the next post, I’ll discuss why, even if the US eliminated its trade deficit, factory jobs are not going to double. Firstly, who would fill those jobs? There is already a shortage of factory workers. Secondly, what would happen to the rest of the economy if 10% of the workforce left their current jobs to shift to the factories?

To receive new posts and support my work, consider becoming a free or paid subscriber.

To provide more support, donate several subs at $50 each. You do not need to name the sub recipients, just how many. This is a one-time contribution; it does not repeat automatically. Please click the button below.

Yes, that is consistent with IS balance theory in economics.

It's clear that Trump's sense of cause and effect is very definite and very flawed, and that he is extremely intolerant of evidence and argument to the contrary. Thus we can expect him to misattribute the causes of his reverses and double down on the erroneous policies, while furiously attacking anyone who dares speak the truth.