Trump Trade War Predicted To Decimate Japan’s GDP Growth Through 2029

MAGA Becomes MAGSA (Make America Grow Slowly Again)

Source: Daiwa Institute of Research https://www.dir.co.jp/report/research/economics/japan/20250403_025016.pdf Note: This shows the subtraction in the level of GDP from what it would have been without the trade war

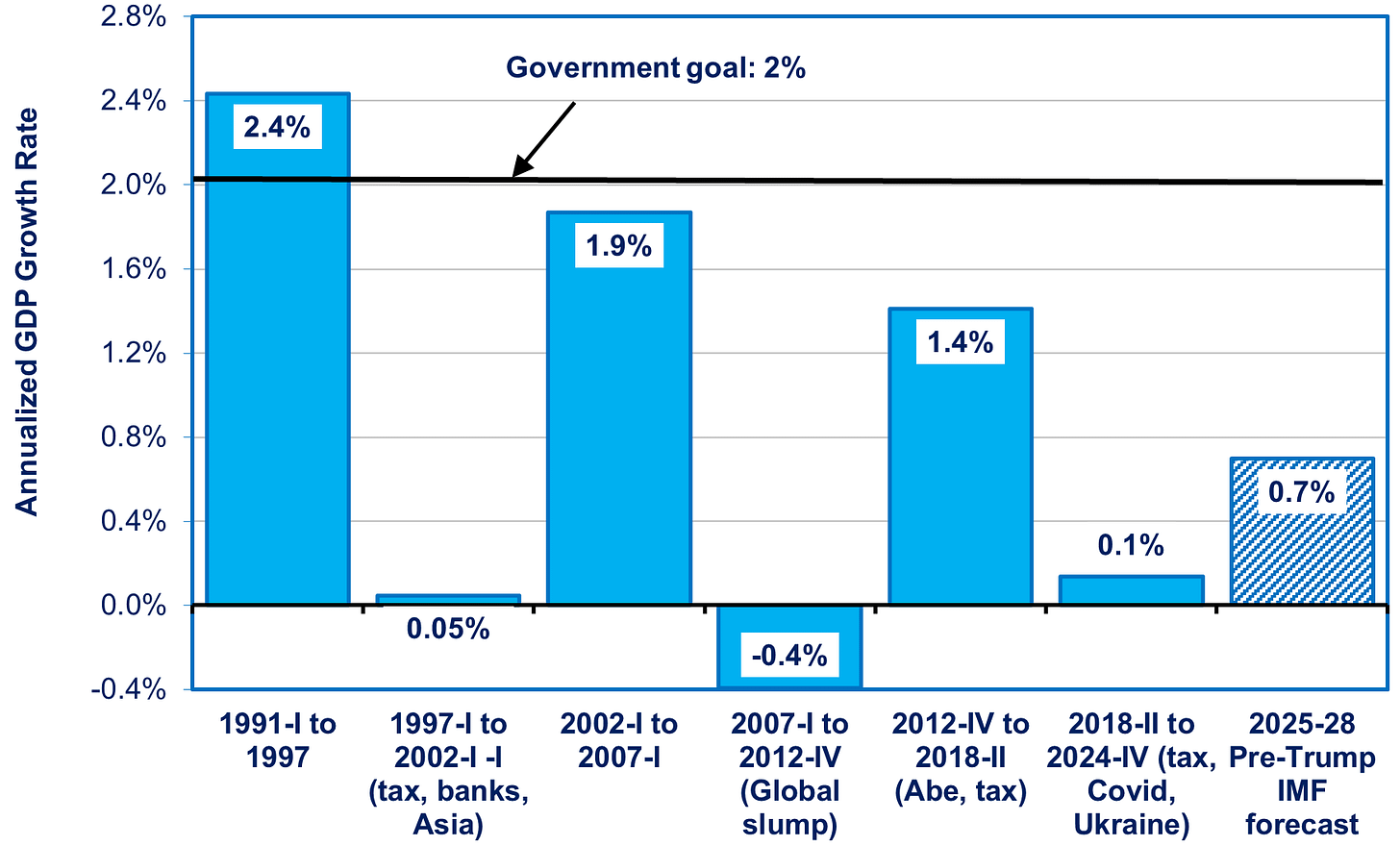

If Daiwa Institute of Research is correct, Trump’s trade war will reduce Japan’s real GDP this year by 0.6% from what it would have been, and, in 2029, by virtually 3% compared to what it would have been (see chart above). If so, then the Trump tariffs will erase three-quarters of the growth that the IMF had predicted for Japan over the coming five years. Of that 2.9% impact, 1.8% comes from the direct impact of Trump’s tariffs on Japan itself. The rest comes from the indirect effects on Japan of Trump’s trade war in reducing growth in China and other purchasers of Japan’s exports.

If you think Japan will suffer, consider how much harm Trump inflicts on America itself, according to a forecast from Japan’s Institute of Developing Economies (IDE). In a report released before the April 2nd announcement, the IDE projected that the Trump tariffs on autos, steel, China, etc., would subtract 0.6% from what global GDP was expected to be in 2027. However, it would subtract 2.7% from America’s own GDP in 2027. That’s a recession-sized drop. Due to the April 2 tariff hikes, JP Morgan has already raised to 60% the likelihood of a recession in the next 12 months, and others will also increase their risk assessment. Moreover, I suspect expectations for medium-term growth will also fall. Trump has turned MAGA into MAGSA (Make America Grow Slowly Again).

There is so much uncertainty about the future that none of these forecasts should be taken too seriously. Their value lies in showing the order of magnitude of the damage if these tariffs are maintained and if the trade war worsens. China’s announcement of 34% tariffs on all US imports shows the growing danger. Not since the early 1930s has the world experienced anything like this.

This is a particular danger for Japan. Its economy seems to be highly sensitive not only to domestic shocks, like the bank debt crisis and consumption tax hikes, but also to external shocks, like the Great Recession of 2008-09 and COVID-19. For the past 30 years, it's gone through a cycle of a half-dozen years of growth and a half-dozen years of stagnation. The Trump trade war will likely extend the duration of the stagnation since 2018.

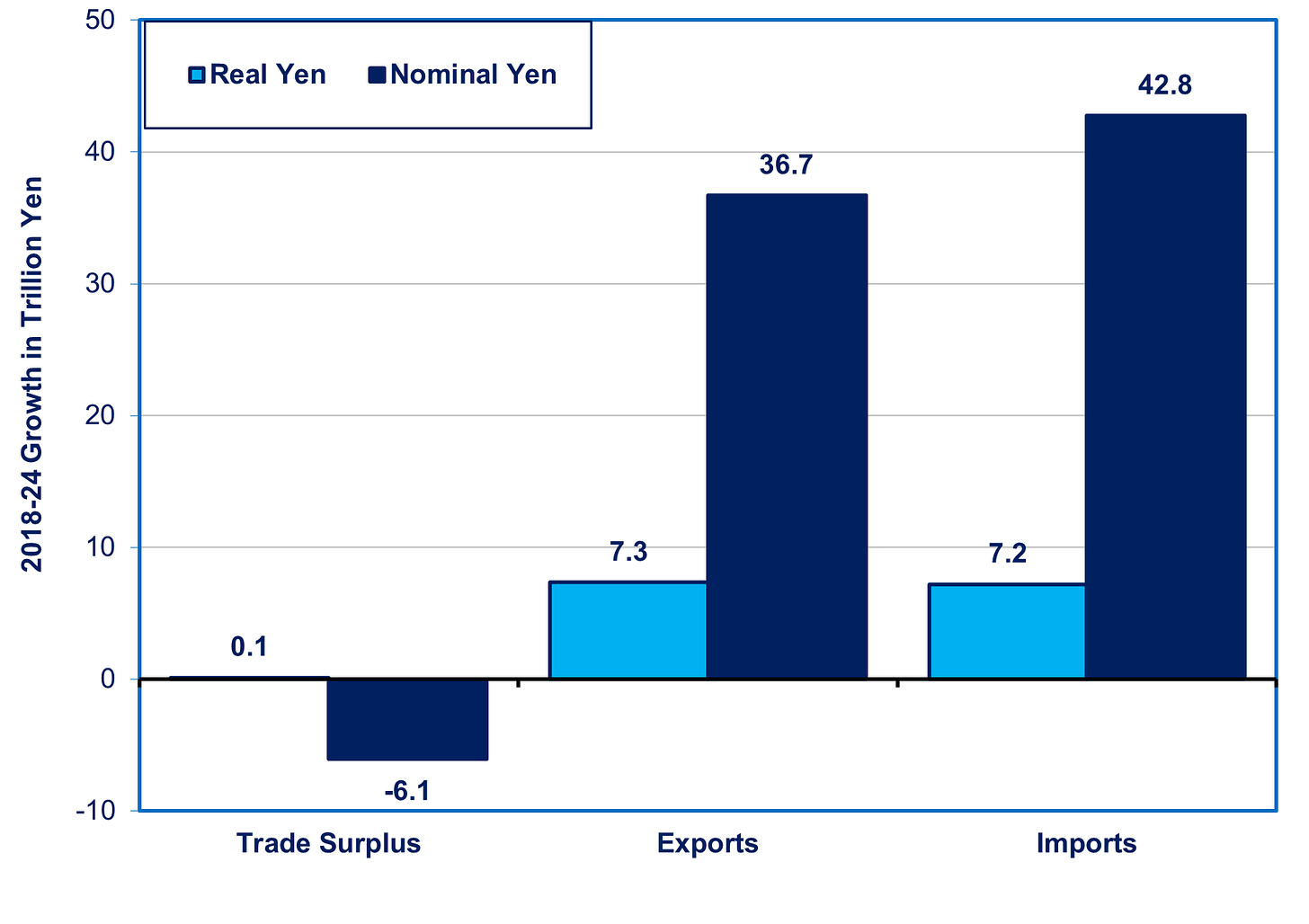

Source: Cabinet Office at https://www.esri.cao.go.jp/jp/sna/data/data_list/sokuhou/files/2024/qe244_2/tables/gaku-jk2442.csv

Little Method In the Madness

While many observers look for the method in Trump’s madness, there’s more madness than method. His actions have probably shattered illusions among many in Japan that Trump would rule with a reasonable businessman’s outlook. Even the calculation of the tariffs was based on a combination of blind ideology and a pack of lies.

At first, the White House insisted that it had done the onerous job of calculating all the tariff and nontariff barriers. But it was caught in a lie. Instead, all it did was divide America’s trade deficit with each country by how much the US imported from them. Having been caught, the White House insisted that this was a good proxy for the size of all the tariff and non-tariff barriers on the grounds that any trade deficit must result from cheating. In a statement, the White House declared, “Reciprocal tariffs are calculated as the tariff rate necessary to balance bilateral trade deficits between the U.S. and each of our trading partners. This calculation assumes that persistent trade deficits are due to a combination of tariff and non-tariff factors that prevent trade from balancing.” Then, to be “nice,” Trump made the tariff half that number. For example, America’s trade deficit with Japan in goods alone, no services, equals 46% of America’s imports from Japan. Half of that is 24%, the tariff applied to Japan.

Then, to add to the lies, trade czar Peter Navarro insisted that the tax (tariff) hikes on imports were actually a tax cut.

The whole notion that America should have no trade deficits with any country is the worst sort of ideology. I gladly run a trade deficit with my grocer and barber because I run a trade surplus with those who pay for my services or my writing. America can run a trade surplus with those who need its digital services or wheat or cars to pay for its deficits with those who provide it with oil and seafood. But if America runs a big overall deficit, then it will run a deficit with many countries. That’s not cheating, it’s arithmetic. If you then ask why it runs such a big chronic deficit, it’s because America habitually consumes more than it produces, and it can only do so by running a trade deficit (see this post).

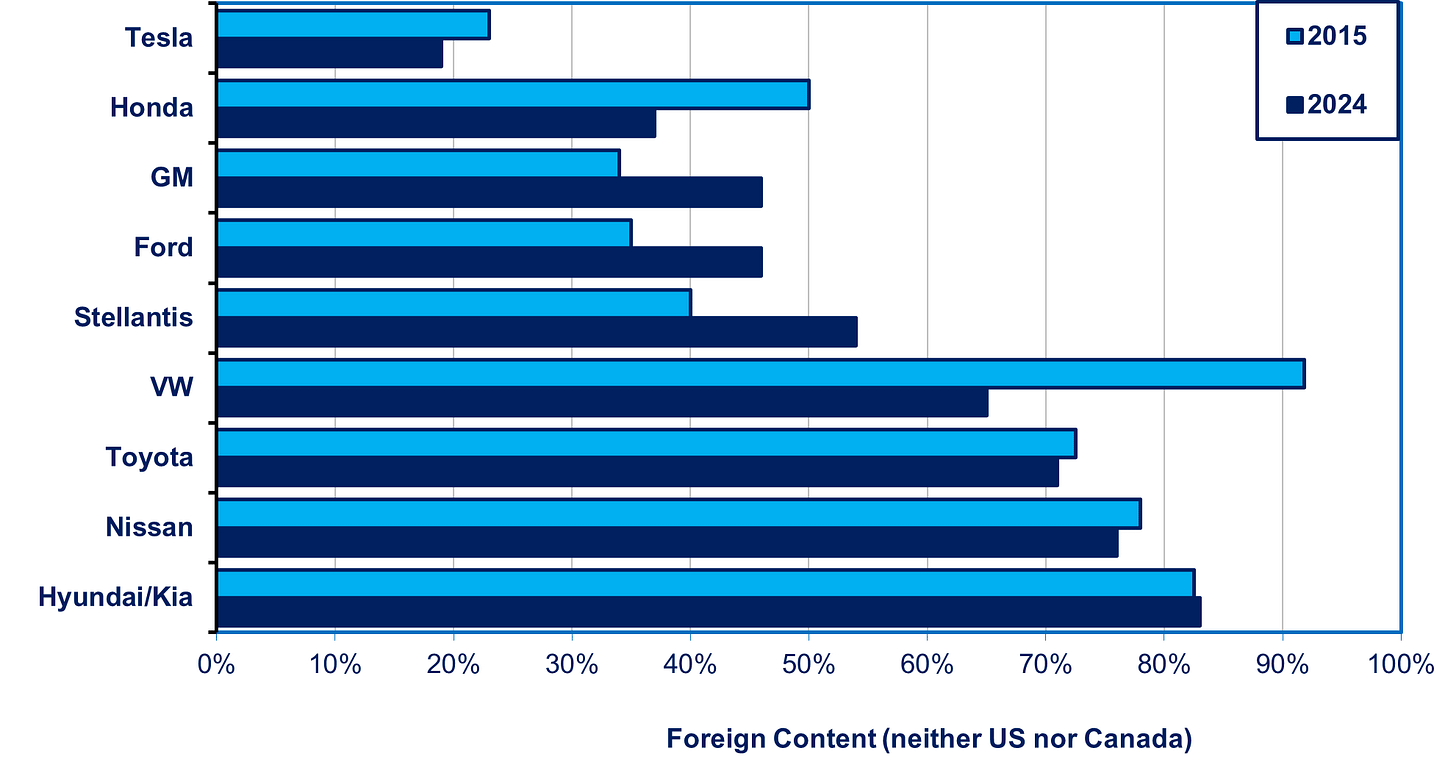

The MAGAites are not just malevolent and ideological. They are bumblers akin to the notorious “Keystone Cops” in the old silent movies. They fired bird flu scientists at a time when bird flu makes jt hard to find eggs in the store at any price, and when you can, the price is outrageous. They claimed that tariffs would create automotive jobs when their tariffs will make Detroit less competitive in the export market, and higher prices will cause sales to drop in the US (more on that below). Trump says he doesn’t care about high auto prices because that will cause customers to switch to American cars, as if supply chains built over decades can be switched overnight. It takes years. In fact, the US and Canadian supply chains are so interlinked that, when the US government measures domestic content, it includes Canadian as well as US content. And even though, aside from Honda, foreign brands have less US-Canada content than Detroit brands, the foreign (neither the US nor Canada) content is still around half. The pure US content is much higher. It’s pitiful that the United Auto Workers union thinks Trump’s gambit will help its members.

Source: https://kogod.american.edu/autoindex/2024

Dollar Sinks A Bit Vis-À-Vis Yen

Normally, when a country imposes moderate tariff hikes, its currency rises a bit. That’s because tariffs lower the trade deficit, and a lower deficit means US buyers have less need to buy foreign currencies. And so that’s what most economists expected would happen this time. In reality, the opposite happened in reaction to Trump’s onslaught: tariff hikes not seen in almost a century. The US stock market fell 5%, the biggest one-day drop since Covid. That, in turn, led to a 2% drop in the dollar vis-à-vis 16 currencies that account for 80% of all daily trading in currency markets. Relative to the yen, the dollar weakened from around ¥150 to ¥146.

The economists got it wrong because the size of the trade deficit is not the only factor in the dollar’s value. They didn’t expect such Draconian tariffs and didn’t factor in the impact on America’s growth and market reaction to the growth slowdown.

In my posts, I have mostly emphasized how much the yen's value depends on the size of the gap between American and Japanese interest rates on ten-year government bonds. Right now, rates in both America and Japan are tumbling.

However, the dollar's value also depends on how much growth investors expect in US GDP and corporate profits, and thus their expectations for stock prices. If international investors now expect slower growth in the US in the medium term and a recession in the short term, they will send less money to the US stock market. That means they need to purchase fewer dollars. In fact, according to the Wall Street Journal, over a five-year period, there has been a high 70% correlation between the value of the dollar vis-à-vis the Euro and the difference between returns to shareholders on the US and German stock markets.

Nonetheless, 2% is a small drop in the dollar, and that’s just the initial reaction in a market shocked by the severity of Trump’s actions. It will take a while to see what evolves in the currency markets.

As for Japan, even with this bit of strengthening, the yen is still at or below the trend line since last August. In the chart below, the two dots within the circle show the previous two days of trading.

.Source: Author calculations based on WSJ data

The Hit To Japan’s Exports and GDP Growth

A few trends will show why the trade war will cause such severe harm to Japan.

Firstly, Japan’s exports are far less competitive than they used to be, and a 24% tariff rate will make them even less competitive. Consider this. The yen has depreciated 27% in recent years, from ¥110 in 2018 to ¥151 in 2024. Policymakers believed this hefty a price drop would boost GDP growth by increasing Japan’s trade surplus. No such thing happened. In constant prices, exports increased no faster than imports, so the real trade surplus barely moved. On the other hand, import prices rose even more sharply than export prices, and so, in nominal terms, the trade deficit worsened. Japan got the worst of both worlds: paying more for imports while failing to get any boost to growth from exports (see chart below). Now, despite the weak yen, Trump’s trade war will reduce Japan’s real surplus and thus GDP growth.

Japan’s auto exports to the US account for almost 30% of Japan’s exports to the US and 20% of its total global exports. However, Trump’s tariffs are predicted to hike the price of new cars by thousands of dollars. And that will cause even more people to buy fewer new autos and more used ones. Already, in 2024, people bought 39 million used cars and light trucks (like SUVs and pickups) and just 15.6 million new autos. That’s because prices are so high, 44% of all new vehicles cost more than $50,000, and only 13% cost less than $36,000. All of the Detroit Three have stopped even producing a mid-size Sedan. Rather, they are focusing on the affluent who can afford expensive SUVs and pickup trucks. The top fifth of American households, with an average annual income of $265,000, accounted for 55% of expenditures on new vehicles last year, up from 40% in 2020, And the second most affluent 20% accounted for another 22%. A price hike of several thousand dollars will not only cause even more potential buyers in the bottom 60% to switch to used cars, but also more of those in the top 40 to either buy used cars or less expensive new cars, including the typss that Detroit has abandoned. What will that do to automotive jobs?

Finally, let’s examine how Trump’s 54% tariffs on China and 25% on Korea and big hikes in the rest of East Asia will hurt Japan. The more that China and Korea export to the US, the more Japan can export to them. That’s because so much of what Japan exports serves as input to manufacturing exports in those two countries. For example, there is a 75% correlation between Japan’s exports to China and China’s own exports to the US. However, there is only a 50% correlation between Japan’s exports to China and China’s GDP growth. A similar pattern exists with Korea and other East Asian countries (see chart below). Even more interesting, Japan’s exports to Korea depend heavily on China’s exports to the US. The correlation is 50%

.

Trump is running a Keystone Cops economy and trying to force the rest of the world to accept it. Whom the gods would destroy, they first make mad.

To receive new posts and support my work, consider becoming a free or paid subscriber.

To provide more support, donate several subs at $50 each. You do not need to name the sub recipients, just how many. This is a one-time contribution; it does not repeat automatically. Please click the button below.

You forgot to add the chart related to the correlation between Japan's exports to countries and these countries' exports to the US