Wage Hikes in April Fail Their First Test

Only 1% Vs. Predicted 2%; Not Enough for BOJ To Hike Interest Rates

Source: https://www.mhlw.go.jp/english/database/db-l/monthly-labour.html

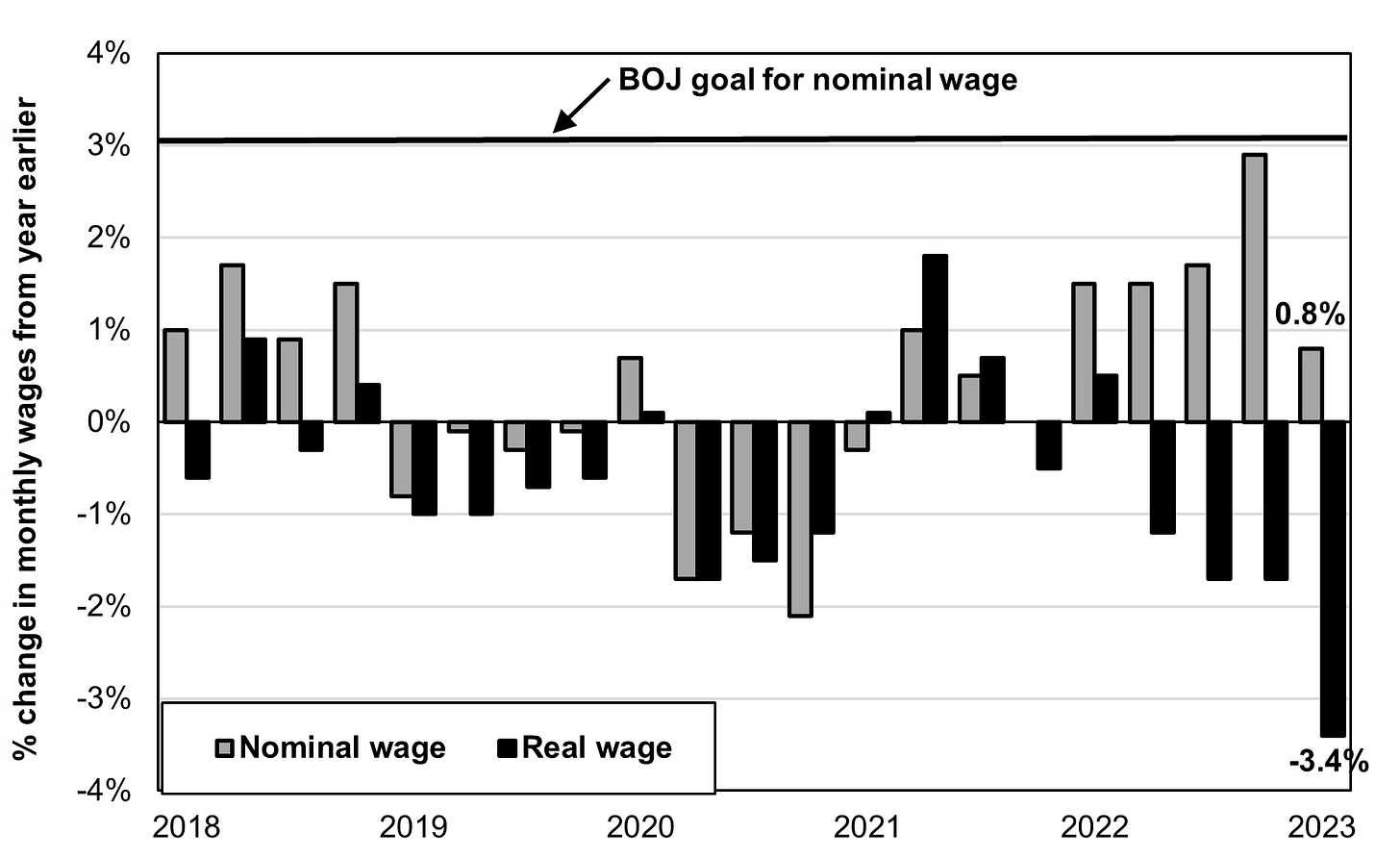

Wages failed their first test in April as to whether the much-ballyhooed wage hikes negotiated by leading companies in the spring would really result in a substantial rise for the labor force as a whole. Economists had expected that nominal monthly wages per worker would rise 2% from the year before, but they only rose 1% (see chart above). The 2% hike was expected because in the annual labor negotiations, known as the shunto, leading companies had agreed to an average 2.1% increase in base pay. (The much-reported headline number of 3.7% includes base pay plus the rate of increase workers get as their seniority rises; the latter does not create a rise for the labor force as a whole).

Officials cautioned that the results won’t be fully known until May or June, because different companies implement their hikes for the year at different times.

Still, there is no doubt that this was a disappointment. “While we must wait until May to see the full picture of the shunto results, April’s growth wasn’t as strong as expected,” Takeshi Minami, chief economist at Norinchukin Research Institute, told Reuters. That disappointment was amplified by a 3% drop in real wages, i.e., nominal wages minus inflation. The disappointment was also amplified by a 4.4% drop in nominal household spending in April. This was the second consecutive month of a year-on-year decline in consumption.

These results will reinforce the reluctance of the Bank of Japan (BOJ) to let interest rates rise. As a result, the gap between Japanese and American rates will remain at a level that keeps the yen weak; at present the yen is around ¥139-140 per dollar.

The BOJ says that it cannot change its monetary ease until it sees clear evidence that core consumer inflation is set to rise at a 2% annual rate on a sustained basis. For this to happen, says the BOJ, nominal wages must rise at a 3% rate. Given its expectation of 1% growth of labor productivity, a 3% nominal wage hike results in a 2% hike in labor costs to employers, a cost that the BOJ believes they would pass onto consumers. In the absence of such wage hikes, the BOJ expects the current high rate of inflation to drop below 2%.

Critics say that the BOJ is underestimating the force and likely persistence of inflation, but, as discussed in a previous post, markets currently lack the power to force the BOJ’s hand.

Real Wages Continue to Drop

Japan’s drop in real wages is not a temporary result of its post-Covid bout of inflation but is a problem of years’ standing. Real monthly wages per worker had already fallen by almost 6% from 2010 through 2019 before Covid. Then, the post-Covid inflation caused them to fall even further (see chart below). Much of this was the result of the replacement of many full-time regular workers with lower-paid non-regulars, as well as the two hikes in the consumption tax (2014 and 2019). If the real wages prevailing during the first four months of 2023 continue throughout the year, then real wages this year will end up almost 10% below the 2010 level.

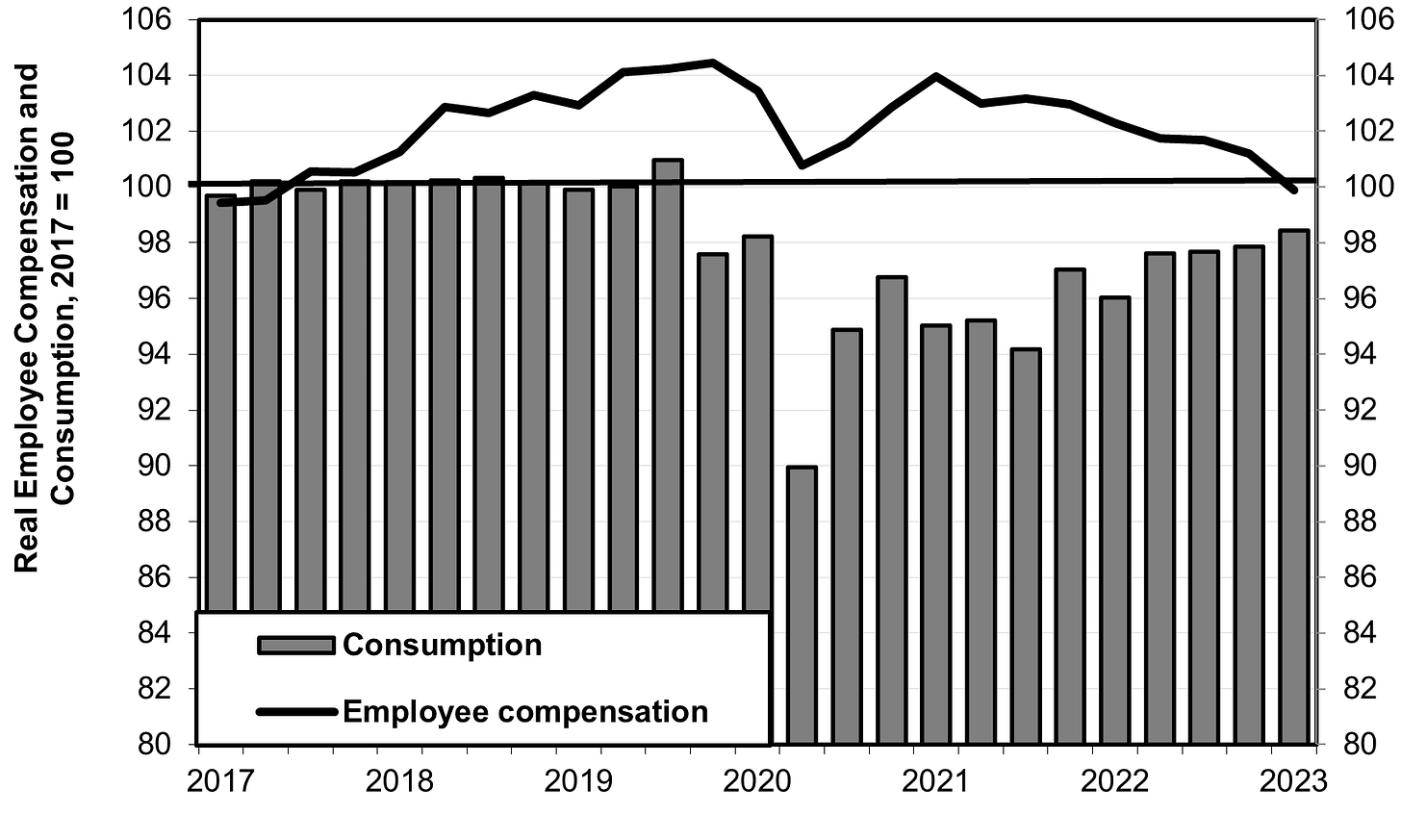

Naturally, falling income results in slack consumption. Total real employee compensation of all workers combined in the first quarter of 2023 was no higher than it had been in 2017. As a result, total real consumption in the first quarter of 2023 was 1.6% below its level in 2017 (see chart below).

Source: https://www.esri.cao.go.jp/en/sna/data/sokuhou/files/2023/qe231/gdemenuea.html

What To Look For In the Coming Months

Since many companies have not yet implemented the wage hikes negotiated in the spring, the Kishida administration and BOJ hope that May and June results will be better.

Time will tell, but there are some other indicators, and they are not encouraging. The shunto negotiations involve only the largest companies who employ but a sliver of the overall labor force. The key question always was whether small and medium enterprises (SMEs) would also hike wages. According to a survey by the Japan Chamber of Commerce and Industry (JCCI), just a third (34%) of SMEs have raised base pay since April 1st, while others raised seniority pay or applied some special one-time-only allowance. As noted earlier, the base pay is what counts for an overall rise in labor income.

There is one possibly encouraging sign for wages. Only a third of SMEs who increased pay did so because of improved performance. The other two-thirds did so because labor shortages or the shift of their employees to better-paying firms forced their hands. The increase in labor mobility is an important factor in strengthening workers’ bargaining power.