Tokyo: No Trade Pact Unless Trump Relents

Immediate Future: High Tariffs and Threat of Renewed Financial Market Frenzy

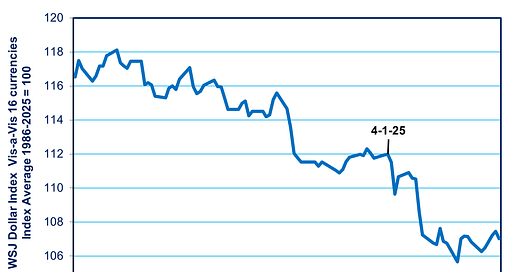

Source: WSJ dollar index Note: Dollar’s value vis-à-vis 16 major currencies

Both Tokyo and Washington are digging in their heels on Donald Trump’s trade war. If neither alters its position, it will be hard to get a trade deal by July 9 when the “pause” ends on Trump’s sky-high “reciprocal” tariffs. That means both Japan and the US economies will continue to suffer the economic pain of Trump’s 25% tariffs on automotive and steel products, along with Trump’s 10% tariff on almost all products from all countries. Washington also faces the threat of a renewed rebellion in the financial markets.

Tokyo is now saying it will not strike a trade deal with Donald Trump unless it includes all tariffs, including those on automotive products, something the US refused to do in the bilateral talks last week (see this post). Trump’s aides contended that these are global tariffs, and Japan cannot get a special exemption. After speaking with Prime Minister Shigeru Ishiba, Japan’s negotiator Ryosei Akazawa told reporters, “We cannot reach an agreement if that [the auto tariff]) is not properly addressed in a package.”

The Trump Administration wants to limit any negotiations to Trump’s “reciprocal” tariffs, which are a function of the size of America’s trade deficit with each country. The rate on Japan is 24%, including a 10% baseline tariff on all countries already in effect. The remaining 14% is now paused. Given the market uproar in April, it remains unclear what Trump will do if no agreements are reached with Japan or other countries.

Economic Impact

If neither side changes its position, we will enter a world of high tariffs for an indefinite period. S&P Global Mobility projects that the automotive tariffs on Japan and most others will continue through the rest of 2025 and 2026. It does not project what will happen after that. Consequently, S&P projects a 9% drop in auto production in North America in 2025, around 1.28 million units. This is much larger than the forecast of a 115,000 unit drop in Japan, an amount equal to 1.6% of the 2024 production level. But, of course, it will also affect Japanese transplants in the US, which made 3.3 light vehicles, about one of every five cars produced in North America. Still, workers and buyers in the US will suffer the most.

As for GDP growth, the IMF has lowered its 2025 forecast for the US by 0.9 points, from 2.7% forecast in January to just 1.8% now. That’s a larger drop than its forecast for Japan, which has been lowered by 0.4 points, from 1% to 0.6%. The IMF's forecast assumes that the current level of tariffs will be maintained, and that this will provoke retaliation.

Financial markets have calmed down since early April, on the presumption that trade agreements and a spate of product exemptions, would let Trump pull back from the sky-high tariffs announced in April 2nd. If that presumption proves false, there is no telling how markets will react. The less the markets react, the less likely is Trump to reduce the tariffs.

Meanwhile, the Japanese Finance Minister has walked back comments that Japan’s purchase of US Treasury bonds could be a “card” in the trade talks.

What Does Trump Need To Get To Lower “Reciprocal” Tariffs?

What does Trump need to get from Japan and other countries to lower the “reciprocal” tariff? Does that mean that, if the bilateral deficit is cut by a fourth, then the tariff on Japan would be reduced by a fourth, from 24% to a still-draconian 18%? Or, is Trump willing to alter the entire formula to withdraw most of the tariff? What about the 10% tariff imposed on all countries already in effect? For now, Japan is not pushing for Trump to alter his whole scheme, but to give Japan a special exemption. Trump is not buying it.

If Trump refuses to alter the formula—the tariff equals half of the trade deficit divided by America’s total imports from Japan—then the standoff will continue. That’s because Japan's proposed concessions would barely make a dent in the $63 billion bilateral deficit. Trump has refused to tell Japanese negotiators what he wants beyond completely eliminating the trade deficit, as he told Ishiba at their February summit and repeated to Akazawa in April. That’s not going to happen. So, Tokyo is focusing its negotiating agenda on assorted items that reflect Trump’s rhetorical rants but make little substantive difference.

Buying More Farm Goods From The US Instead of Others

The US supplies over 20% of Japan’s agricultural imports, with China coming in a close second. As detailed in Part 1, Trump's fees on Chinese ships have sent prices skyward on all ships leaving from the US. That makes it price-prohibitive to buy wheat, corn, soybeans, and many other farm goods from the US. So, while Tokyo can talk about buying, it cannot force private companies to comply.

Investing $44 Billion in a Moribund Alaska LNG Project

Trump insists that Japan, Korea, and Taiwan together invest $44 billion in an Alaska LNG project that has languished for years because its LNG would be too expensive. No Asian company has committed itself to buying the LNG, and Exxon Mobil abandoned the project a decade ago, turning it over to the Alaska state government..

If the project ever got off the ground, it would produce 20 million tons per year and, according to the US Department of Energy, could reduce the trade deficit with Japan by about $10 billion per year—an amount equal to around 15% of the current trade imbalance. However, the Japanese government cannot order private companies to make investments or purchases on which they’d lose money.

This is yet another example of Trump’s divorce from even physical realities. Trump has claimed that innumerable countries could “easily” erase their entire trade surplus with the US just by buying more American fossil fuels. On April 6, Trump demanded that the European Union commit to buying $350 billion more of American energy to get a tariff reprieve. What Trump ignores is that the US oil and gas industry is already operating near full capacity and cannot increase its exports by that amount. On the contrary, the depressive effect of Trump’s tariffs on global growth is already reducing energy demand and thus producers’ investment. As the Wall Street Journal reported, “Before Trump came into office, oil production in most U.S. crude regions was set to decline because of maturing fields and dwindling sweet spots. Oil executives expect Trump’s policies to accelerate this trend.” So much for “drill, baby, drill.”

Paying More of the Cost of US Bases in Japan

Another Trump tantrum based on a lie is his declaration: “We pay hundreds of billions of dollars to defend them [Japan]... We pay all the money, they don't pay anything.” In reality, the annual cost of the US military presence in Japan was just $5.2 billion per year during 2016-19. Japan paid 60% of that cost. So, even if Japan paid 100% of the cost, including bowling alleys and golf courses for the troops, the extra few billion per year would make no more than a small dent in the trade deficit.

By the way, when the US practices “forward defense” by having bases all over the world, it protects not only its allies but also itself. The Russians (Soviets), China, Iran, and Islamic terrorists are denied the ability to blockade the US by conquering territory and/or cutting off sea lanes.

Making the Yen Stronger

Trump and his acolytes repeatedly argue that the US runs a trade deficit because other countries deliberately drive their currencies (and thus export prices) downward to drive American companies out of the market. This, of course, ignores that Japan’s Ministry of Finance (MOF) wasted 2% of GDP in 2022 and 3% in 2024 in a futile effort to drive the yen upward.

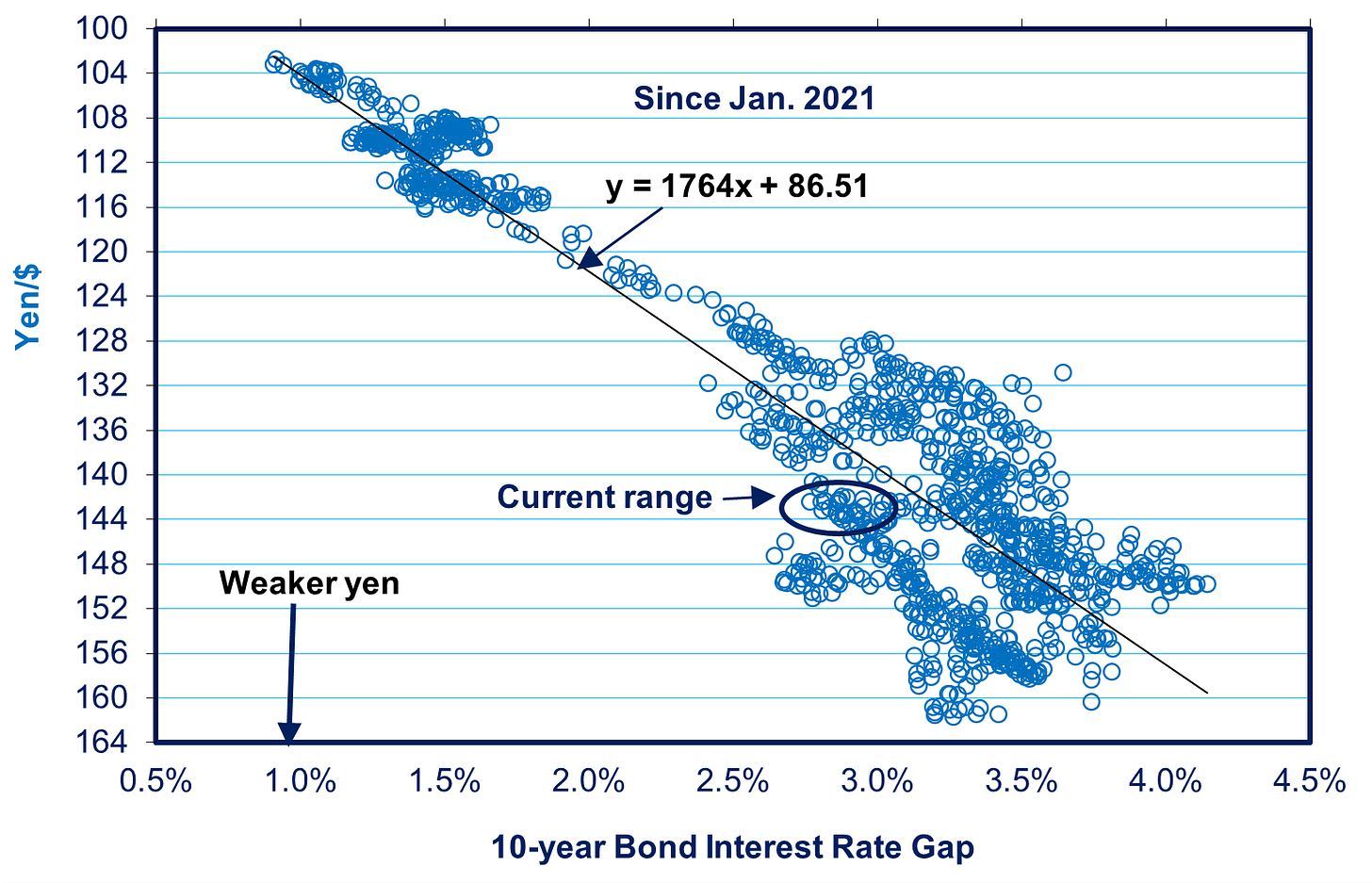

Some Trump officials, like Stephen Miran, chair of the Council of Economic Advisors, have called for coordinated intervention to weaken the dollar. However, intervention only works when a currency is out of whack with economic fundamentals, as the dollar was at the time of the famous 1985 Plaza Accord. However, when the yen/dollar ratio is in accord with fundamentals, as is the case today, intervention is impotent. Since January 2001, the ups and downs of the gap between interest rates on American and Japanese 10-year government bonds have explained 85% of the daily ups and downs of the yen/dollar. When that gap is larger, money is drawn from Japan to the US, and the yen weakens; the yen recovers when the gap shrinks (see chart below).

Source: Author forecast based on data from WSJ Note: Forecast is based on the interest rate gap as discussed in the text

That leads some Trump officials to argue that the Bank of Japan (BOJ) could strengthen the yen simply by raising interest rates. If Japan could lift the interest rate on ten-year Japan Government Bonds (JGBs) to the same rate as American bonds, around 4.2% these days, that would close the gap. That, in theory, would lift the yen to 86/$, as shown in the equation for the trendline in the chart below. Such a strong yen, they imagine, would surely cause Japan’s trade surplus with the US to shrivel.

This is another “quick fix” that ignores economic realities, in this case, “the two impossibles.”

Firstly, even if Japan were successful at raising ten-year bond rates to 4%, the economy would crash, slashing imports. Japan’s trade surplus vis-à-vis the US would rise, not fall. This would happen for the same reason that the US trade deficit declines sharply only when the US is suffering very slow growth or a recession (see this post).

The economy is already suffering a significant slowdown due to Trump’s trade war. That has led Japanese companies to cut purchases and investment. Consequently, the BOJ announced it is holding off from hiking overnight interest rates. In response, the yen weakened from ¥143.07 to ¥145.45.

Secondly, it is impossible to reach a 4% long-term interest rate in the first place. The BOJ has abandoned direct control over long-term rates. So, the economy's crash following such a sharp tightening of monetary policy would reduce demand for credit, thereby sending long-term interest rates downward.

No matter how much Trump stomps his feet, the BOJ and MOF lack the capacity to eliminate Japan’s trade surplus with America. Ironically, the player with the most power to bring down the dollar is Trump himself. By destroying trust in America’s rationality, upping inflation, and possibly sending the economy into recession, Trump has sent investors fleeing from American stocks and bonds, and therefore the dollar itself. That has driven the dollar down by almost 10% since Inauguration Day vis-à-vis against 16 major currencies (see chart at the very top). That will exacerbate US inflation.

Time For Japan To Unite With Other Nations

Up to now, Japan has fallen into Trump’s trap of divide and conquer. It has competed against other Trump victims to gain special exemptions. That is not working. As some Japanese policymakers now recognize, it is time for Tokyo to create a united front with other countries.

To receive new posts and support my work, consider becoming a free or paid subscriber.

To provide more support, donate several subs at $50 each. You do not need to name the sub recipients, just how many. This is a one-time contribution; it does not repeat automatically. Please click the button below.

Thank you for your detailed and logical analysis. I agree with your conclusion. Japan cannot face this tyrant alone.

Fact Check by Daniel Dale on edition.cnn.com

On comments Trump made at Cabinet Meeting ( couldn’t find date)

The federal Government Accountability Office wrote in a 2021 report that data obtained from the US Defense Department showed that from 2016 through 2019, Japan provided $12.6 billion “in cash payments and in-kind financial support” for the US military presence – and also provided “indirect support, such as forgone rents on land and facilities used by U.S. forces, as well as waived taxes.” Over the same period, the report said, the US Defense Department obligated $20.9 billion for the US military presence in Japan.